CHILEAN FISHERIES AND AQUACULTURE: THIRTY YEARS OF ACTIVITIES, DISAPPOINTMENTS AND PROGRESS

Una visión estratégica de realidades, problemática y perspectivas

DESCARGAR / Download

CHILEAN FISHERIES AND AQUACULTURE: THIRTY YEARS OF ACTIVITIES, DISAPPOINTMENTS AND PROGRESS

Carlos Wurmann G

Industrial Civil Engineer, M.Sc., Economics

President of CIDEEA

International Centre for Strategic Studies in Aquaculture

Santiago de Chile, December 2024

The Chilean fishing sector includes extractive fishing and aquaculture activities, the latter being more recent and with a growing relevance that, despite the high levels of the former, reveals the country’s increasing vocation for fish farming rather than with normal fishing.

Extractive fishing increases from about 93,000 tons in 1950 to a maximum of 7.8 million tons (MMT) in 1994, falling to about 2.1 MMT per year in 2015-2017, and recovering to 2.6 MMT per year in 2021-2023. Marine fish accounts for between 66% and 96% of the catches between 1950 and 2023, and pelagic fish, represents 80% to 96% of these marine fish in various years from 1962 onwards. In turn, pelagic landings are mainly composed of anchovy, common sardines, horse mackerel and mackerel, species that together contribute between 52% and 93% of the fish caught since 1990, preferentially destined to the production of fishmeal and fish oil. In 2020-2022, Chile ranks tenth among the world's fishing countries in terms of volumes produced, having reached a third position in several years in the 1980s and 1990s. In that same triennium, Peru is the country with the highest levels of fishing in Latin America, being the third in the world order of catches.

Aquaculture, in turn, is developed more or less experimentally with molluscs and then algae at an artisanal level from the 1950s to 1977, with harvests reaching just over 800 tons per year. In 1978 the first productions of farmed salmonids were recorded (48 tons), which evolved quickly to 1,100 tons in 1985; 101.0 thousand tons (TT) in 1994, and 1.08 million tons (MMT) in 2020. A bit later Chile developed the commercial cultivation of mussels, incorporating technologies from Spain and New Zealand, which, added to a fluctuating production of scallop, abalone, oysters and various other molluscs, exceeded 1,800 tons in 1982; 106 TT tons in 2004 and 400 TT tons in 2020. Clearly, then, national aquaculture is currently focused mainly on salmonids and mussels, with smaller contributions of algae, other molluscs and emerging cultures of marine fish (especially Seriola Lalandi, in recirculation), despite the fact that in 2012 more than 440 tons of turbot were harvested, a species that has since declined and practically disappeared from the national aquaculture grid. In sum, Chilean commercial aquaculture currently produces more than 1.5 MMT in 2023 and ranks eighth in the world by volume harvested in 2020-2022.

Decreasing extractive catches over the last 30 years, and growing crops in the same period have allowed aquaculture, which accounted for only 1.3% of the country's landings in 1990, to contribute with 36.6% to those totals in 2023, and, as seen below, to provide the most substantial portion of fisheries exports, which together reach 1.7 MMT and almost 9,000 MM USD in 2023. The monetary value of sectoral exports represents an extraordinary 9.5% of the total value of goods exported by the country in 2023, and aquaculture, on its own, 7.5% of that total, far surpassing the contribution of exports of extractive fishery products.

There are no reliable recent figures on employment in the fisheries and aquaculture sector in Chile, although informally some 25-30,000 direct jobs in aquaculture, and some 100-120,000 in fisheries, and an undetermined number of indirect posts are suggested.[1]

PRIMARY PRODUCTION

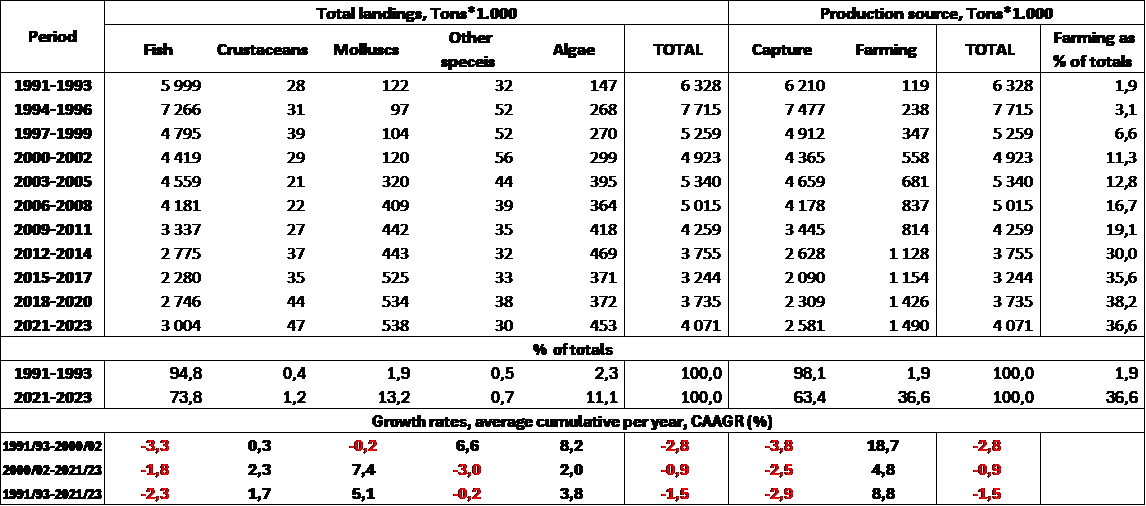

From 1991-1993 until 2021-2023, total landings decreased from 6,328 MM tons to 4,071 MM tons, as a result of decreasing catches between 6,210 and 2,581 MM tons, and increasing farming volumes, between 119 thousand (T) and 1,490 T tons per year in the same three-year periods, which are not enough to compensate for the decreases in fishing volumes (Table 1).

Thus, in the last 30 years, 59% of catch volumes have been lost but farming has increased by 1,154%, with aquaculture increasing its incidence from 1.9% of landings in 1991-1993 to a significant 36.6% in 2021-2023, and landings, as a whole, have decreased by 36%.

Decreases between both trienniums basically relate to wild fish, whose incidence drops from 94.8% of landings in 1991-1993 to 73.8% in 2021-2023, while all the remaining items increase in relative significance. In all, in the last 30 years, extractive fishing has decreased at a cumulative average annual rate (CAAGR) of -2.9%, while harvest volumes increase at a CAAGR of 8.8% and landings, as a whole, diminish by -1.5% per year.

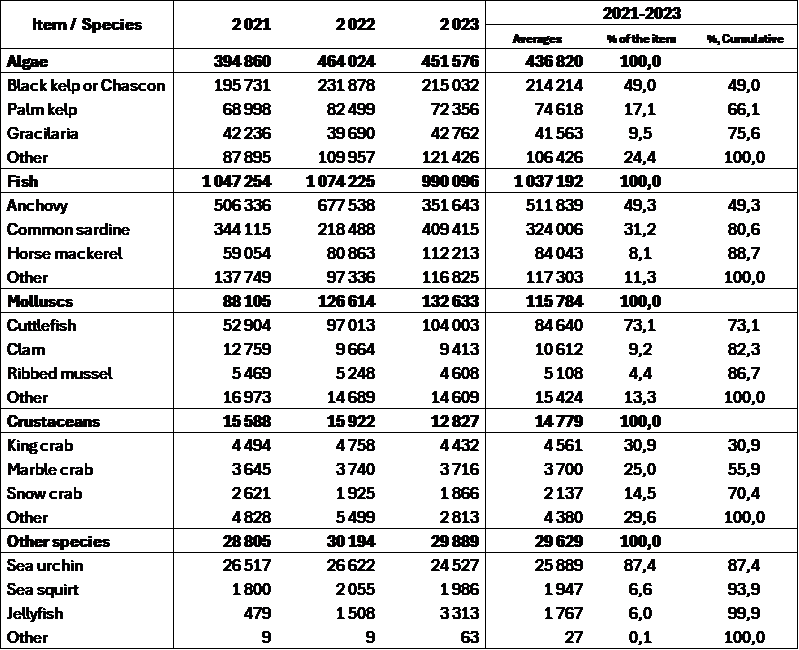

En el caso de la pesca extractiva, en los 21 años que median entre 2000-2002 y 2021-2023, las pérdidas son muy marcadas en peces, aunque no ocurra otro tanto en moluscos y crustáceos (Tablas 2 y 3), fundamentalmente gracias al aporte de jibia y de ‘otras especies’, respectivamente, ya que la mayor parte de las especies restantes han disminuido o aumentado moderadamente a lo largo del tiempo.

[1] The text of the proposed new fishing law mentions 139,000 direct and indirect jobs in fishing, for 2022 (78,000 direct posts).

Table 1 Chile: Fish landings by production category and species group, 1991-2023

Average annual values

Source: Calculations of the study on figures from the Fisheries and Aquaculture Yearbooks, SERNAPESCA, Chilean National Fisheries and Aquaculture Service

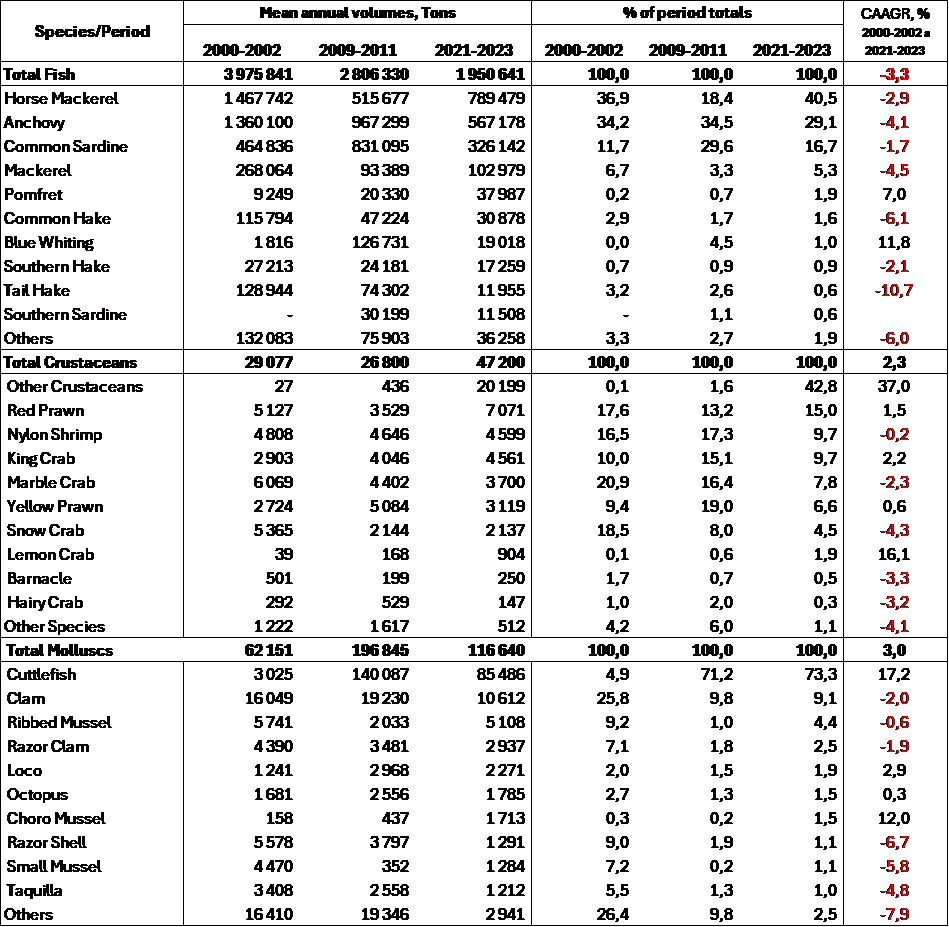

Table 2 Chile: Main species of fish, crustaceans and molluscs in extractive fisheries, according to species ranking in 2021 to 2023. Period 2000-2023

Source: Calculations of the study on FISHSTAT figures, FAO, 2024

Note: Figures for fish have not been depurated and include minor quantities of emerging farmed species

In these last decades, as said, losses are very marked in wild fish landings, although the same does not occur with molluscs or crustaceans (Tables 2 and 3), mainly thanks to the contribution of cuttlefish and ‘other species’, respectively, as with most of the remaining ones, catches have diminished or grew moderately through the years.

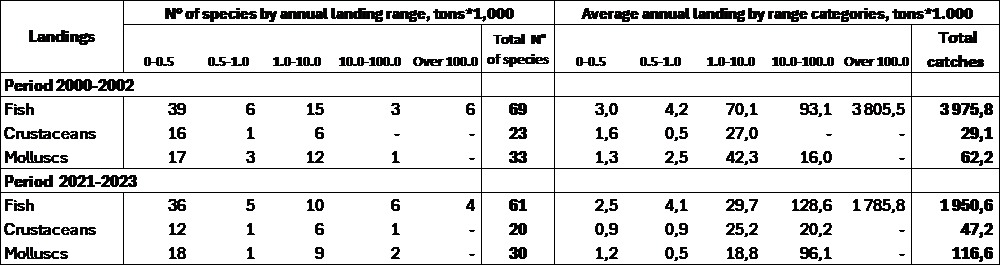

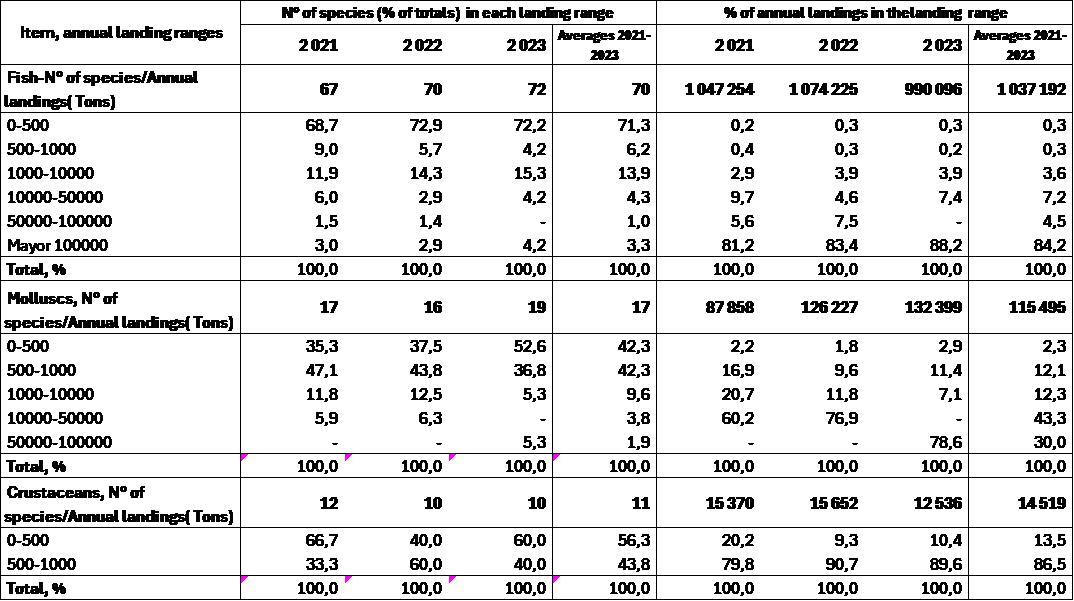

Table 3 Chile: Stratification of the number of species and annual levels of landing, by annual landing range. Figures for 2000-2002 and 2021-2023

Source: Calculations of the study on FISHSTAT figures, FAO, 2024

Note: Figures for fish have not been depurated and include minor quantities of emerging farmed species

In the case of fish, the decline is from about 4 MMT to 2 MMT during the period, at annual rates (CAAGR) of -3.3%, with 7 of the top 10 species showing significant losses, and the remaining fish also falling at a CAAGR of -6%. Additionally, there is a very high concentration of catches in jack mackerel, anchovy, and common sardine, which together contribute more than 82% of the catches of these species in the exposed trienniums. The number of fish species caught decreases from 69 and 61 between 2000-2002 and 2021-2023 (Table 3). The 57% of fish species with landings below 500 tons per year in 2000-2002, (59% in 2021-2023), contribute only 0.1% of the catch volumes in both periods. Notably, the 6 and 4 species caught in volumes that exceed 100 TT per year in those trienniums also contribute 95.7% and 91.5% to fish catches, respectively.

In the case of crustaceans, with no significant aquaculture crops for now , catches have advanced between 29 and 47 TT between 2000-2002 and 2021-2023, with a CAAGR of 2.3%, basically due to the performance of the 'other crustaceans' category, which increases rapidly, while 6 of the 10 main species register negative growth rates. Here, 23 species have been captured in 2000-2002 and only 20 in 2021-2023. 70% of the crustaceans caught generate landings of less than 500 tonnes per year in 2000-2002 and 60% in 2021-2023, contributing with only 0.9% of the total catches of these species in both periods, while most of the catches (92.8% and 53.4%, respectively) are concentrated in the 6 species whose annual extraction fluctuates between 1,000 and 10,000 tonnes per year. Crustaceans are not caught in volumes greater than 21,000 tons per year in 2021-2023.

Molluscs fishing/extraction has evolved from 62 and 117 TT in these 21 years. The fishing volumes of the 33 species of molluscs harvested in 2000-2002 (30, in 2021-2023) evolve by 3.0% per year (CAAGR) over these 21 years, this time, thanks to the notable growth in cuttlefish catches (17.2% CAAGR), while 7 of the top 10 species (including item ’others’) show decreasing trends.

Efforts to sustain landing levels of all these species over time have been growing on the part of State and/or private agencies dedicated to research in this area, but results have not been entirely satisfactory, because of decreasing number of species landed; a good number of them fished in volumes of less than 500 tons per year, and an important group showing negative growth rates. These situations conspire against the desire to increase domestic consumption per person of fishery products, an issue that, having received some attention from sectoral agents, has not been addressed in a sustained manner or thinking about these realities and the sustainability of a sufficient domestic supply of 'white' fish species, although they could be complemented with a wide range of local fatty fish, even though really, this last category does not necessarily have the approval of a significant part of the population. Thus, local consumption has gradually been supplemented by growing imports in recent years, beyond the relatively minor contributions by crustaceans, molluscs and aquaculture. In this latter case, farmed fish, mainly salmon and trout, the activity is mostly concentrated on exports, whose prices do not yet allow for higher levels of domestic intake.

AQUACULTURE

Farmed products, which in 2021-2023 account for 36.6% of total Chilean fish landings (35.1% in fish and 78.3% in molluscs) predominate in volumes exported since 2012, and in value terms since 2000. Farmed export values per kilogram (FOB) exceed two or three times those of conventional fishery products. More importantly, Chilean aquaculture -as opposed to capture fisheries-shows enormous development possibilities, both in medium and large-scale activities intended for exports, together with artisanal or family/small-scale work which is very relevant in satisfying local demand and generating jobs, particularly on the southern part of the country.

Since 2020, and with a small drop in 2021, Chilean aquaculture has produced more than 1.5 MM tonnes per year, with almost 1.1 MM tonnes attributable to salmonids (salmon and trout) and about 400 thousand tonnes to molluscs, basically mussels, with relatively lower contributions of algae and negligible amounts -but with clear possibilities of increase- in emerging species such as yellowtail kingfish, sturgeon, meager and red conger eel, among several others.

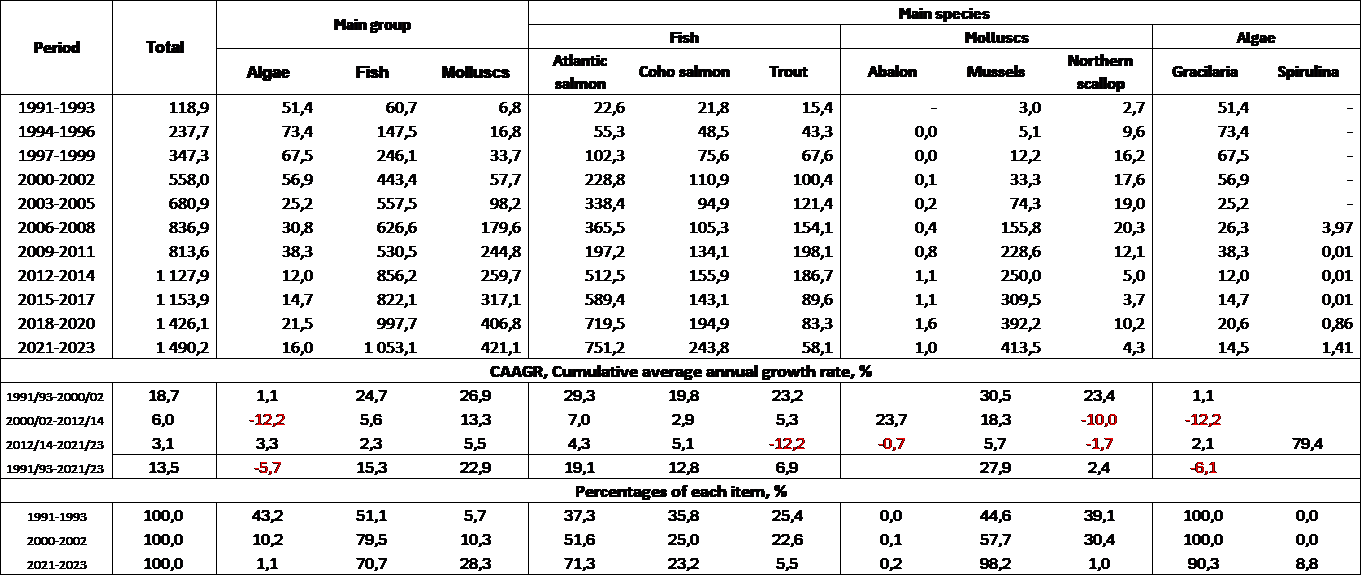

Fish are the dominant farmed species in the country, accounting for 70.7% of volumes in 2021-2023. Among them, Atlantic salmon stands out since the 1990s, with 751.2 TT per year, followed by coho salmon, with 243.8 TT per year and trout, with 58.1 TT per year in that same period. Mussels or ‘choritos’ stand out among molluscs, with 413.5 TT per year in the same period together with several other species such as northern scallop and red abalone, this last one, introduced from California in the early 1990, after a thorough impact report study. Among algae, the ‘pelillo’ (Gracilaria chilensis) harvest has always stood out, with 14.5 TT per year in 2021-2023, and recently Spirulina, with an average of 1.4 tons per year in the three-year period.

[1] ,

Table 4 Chile: Aquaculture production by category and main species, 1991-2023

Thousand tons and percentages.

Source: Calculations of the study on SERNAPESCA figures for 2021 to 2023

Crop volumes have advanced at an attractive CAAGR of 13.5% between 1991-1993 and 2021-2023. However, growth rates have been gradually decreasing over time, from 18.7% per year between 1991-1993 and 2000-2002, to 6% per year from 2000-2002 to 2012-2014 and 3.1% between 2012-2014 and 2021-2023 , a trend indicative of a certain level of fatigue in farmed production. This is especially noticeable in salmon farming where the slowdown is even greater than in sectoral totals , a fact that cannot be attributed to technological or productive reasons, if not mainly to diseases and governance issues. Here, for instance, salmon farming is clearly overregulated, and there have been and there are strong disagreements between salmonid producers and governments which have hindered further development, making producers incur as well in exaggerated costs and procedures, facts which add up to obstructive norms in the granting of new marine concessions and/or their relocation. Thus, Chilean salmon farming, which in its time was the most competitive in the world, today works with much higher costs that challenge expansion to new markets and deepening sales efforts on the currently accessed destinations. There are local advantages as well, as Chile is the only world producer of captive coho salmon in significant quantities, even if the country has not yet taken advantage of this excellent market opportunity for technical reasons that this far could have been addressed (high seasonality patterns and others).

In any case, Chilean aquaculture growth rates exceed world values, although distances between these figures are decreasing.

The extraordinary thing about local aquaculture is that it initially flourished in an environment heavily dominated by extractive fishing, which placed the country among the top 10 fishing nations in the world. Thus, traditional fishing enterprises did not incorporate into fish farming from its very beginnings and most initial investors in this field came from various dynamic economic areas, a fact that injected particular energy to this activity, which in a matter of a few decades turned the country into a ‘top-ten’ actor in world aquaculture, heading as well Latin American harvests.

Should current administrative/legal limitations be maintained or should the new and forthcoming aquaculture law insist on its main inconveniences, Chilean salmon farming could slow down substantially. Otherwise, it will continue progressing, although at lower rates than those of the last 30 years, while disease and parasite-related issues remain unsolved and are a cause of concern , being responsible for heavy losses which force the industry to work at moderate densities and under management schemes that require to paralyze production for limited periods of time in well defined 'neighborhoods', when harvests are completed. Thus, restrictive norms, overregulation, lower densities, mandatory shutdown periods, diseases and other factors have made national salmon less competitive, precisely at a time when salmon production is beginning to prosper in ever more efficient land-based recirculation systems in several countries to which Chile exports this species, challenging future local capacities to compete with such ventures.

No doubt, the most important increases in Chilean harvests should continue to be associated with salmon, trout and mussels for at least the next 15-20 years, although it is expected that CORFO's financing in past and recent exploratory activities to diversify production will bear fruit from the end of this decade and the beginning of the next one, incorporating species such as yellowtail kingfish (Seriola lalandi), the meagre and the red conger eel into the national productive matrix, in parallel with the sea urchin, diverse flatfishes and greater quantities of various molluscs.[1].

Countries such as Brazil, which has extraordinary conditions for hydrobiological farming in fresh and seawater, and which currently imports significant quantities of fishery products, could exceed Chile’s harvest volumes at some point in the coming decades. Likewise, Ecuador, with its spectacular shrimp industry that already exceeds 1 MMT per year can also challenge national leadership in the future, if it undertakes a vigorous diversification process.

It should also be mentioned that but for the case of mussels, a few other molluscs and certain algae, small-scale farming activities have not yet acquired any significant notoriety along the Chilean coast, a matter that does not speak well of the efforts of the State to facilitate and promote these activities that are so relevant for the generation of work posts, wealth and food security in many regions. Here, governmental support is mainly based on marginal impulses, poorly sustained over time, which have not generated stable productive development worth highlighting, at a time when coastal fishing is scarce, and smaller-scale crops would be extremely welcome in the domestic market.

If changes in aquaculture management in the country are implemented, creating -for instance-the Undersecretariat of Aquaculture on the near horizon, it is likely that many governance problems affecting small scale aquaculture can be remedied, as well as those that afflict medium and large size aquaculture. This eventual fact, plus a reengineering of the R&D systems in the country could constitute tools that trigger a second phase in the development of national aquaculture, which already stands out, along with fishing, for being the second source of exports of goods from Chile in recent years.

In all, and as has been pointed out, Chile is currently the world's second largest producer of farmed salmon and mussels, and its production flows to a good number of markets, with the United States of NA, the European Union, China, Brazil and Japan topping the list of foreign clients in several cases.

ARTISANAL FISHING

A significant part of the seafood domestic supply has always been based on a wide variety of species provided by artisanal fishing, which were preferably marketed 'fresh'. In recent decades, however, and contrary to the success achieved by artisanal fishermen with capacities that border on industrial work with pelagic fish and cuttlefish, especially in the south-central area of the country, many of the coastal species demanded by local consumers have decreased their landings, as a result of overexploitation. Thus, artisanal fishing volumes are currently concentrated in species used in the production of fish meal and oil, frozen cuttlefish products for export, and the extraction of algae (between 26% and 28% of artisanal catches between 2021 and 2023). This fact, together with lower catches of species of high domestic demand, have resulted in a limited local supply, affecting domestic consumption, which is then partially supplemented by growing imports.

[1] .

Table 5 Chile: Catches/extraction in artisanal fisheries by item and main species, 2021-2023

Tons and percentages

Source: Calculations of the study on SERNAPESCA figures for 2021 to 2023

FAO estimates indicate that the total apparent consumption of fishery products per person in the country reaches 14.4 kilos/year in 2022, a figure slightly lower than the 14.8 kilos/year of 2019, the maximum figure for the period 2010-2022, where the minimum value is 12.8 kilos/year in 2016.

Almost 89% of the fish caught in artisanal activities (except for an indeterminate portion of horse mackerel) are not destined to direct human consumption as fresh products (Table 5). The same happens with a significant proportion of molluscs and crustaceans, which are exported in various presentations. As told as well, a large number of species in artisanal fisheries are currently caught/extracted in relatively modest quantities (Table 6), and very often, in lower volumes than in previous decades, a fact which reinforces the idea that an important part of small-scale fishing in the country is fairly fragile.

More than 71% of the 70 species of fish caught by artisanal fishermen are extracted in volumes of less than 500 tons per year in 2021-2023 and contribute only 0.3% of the volume of fish landed by artisans in that period. In molluscs, 42.3% of the 17 species are produced in volumes of less than 500 tons per year and contribute a meager 2.3% of the catches of this item. In turn, 60% of the 11 species of crustaceans are also caught in volumes of less than 500 tons per year and contribute only 13.5% of these catches.

These facts, for sure limit local seafood consumption, a situation that has not received careful attention from the State, industry or consumers, who seem to be somehow ‘satisfied’ with this state of affairs.

The situation of the availability of the most important fish species in the country is also partly reflected by the fact that, in 2023 'of the 28 fisheries reported, considering those fisheries whose conservation status is not updated, 11% (3) are underexploited and 36% (10) in a state of full exploitation. On the other hand, 9 fisheries are registered in an overexploited state (32%) and 6 (21%) in a depleted condition.' 'If only the 24 fisheries that have an updated status are considered, 13% (3) are underexploited, 42% (10) in a state of full exploitation, 37% (9) are overexploited and 8% (2) are in a depleted condition, obtaining 55% of the fisheries in a healthy state' . The rest of the fishing units have less information at the moment.

Table 6 Chile: Distribution of artisanal catches by main item and annual fishing ranges in tons, 2021-2023

Tons and percentages

Source: Calculations of the study on SERNAPESCA figures for 2021 to 2023

Con todo, también es necesario indicar que es muy posible que una parte no menor de las actividades artesanales no estén bien reflejadas en las estadísticas de captura, y que otro tanto suceda con los registros de pescadores/acuicultores de pequeña escala/artesanales, por las dificultades en obtener la información correspondiente.

Parte de la situación de la disponibilidad de las especies pesqueras más importantes del país queda reflejada indicando que en 2023 ‘de las 28 pesquerías informadas, considerando aquellas pesquerías cuyo estado de conservación no se encuentra actualizado, el 11% (3) se encuentra subexplotadas y el 36% (10) en estado de plena explotación. Por su parte, se registran 9 pesquerías en estado de sobreexplotación (32%) y 6 (21%) en condición de agotada.’ ‘Si se consideran sólo las 24 pesquerías que cuentan con estado de situación actualizado, 13% (3) se encuentra subexplotadas, 42% (10) en estado de plena explotación, 37% (9) pesquerías en estado sobreexplotación y 8% (2) en condición de agotada, obteniendo un 55% de las pesquerías en un estado saludable’[1].. El resto de las unidades de pesca disponen de menos información por el momento.

FOREIGN TRADE

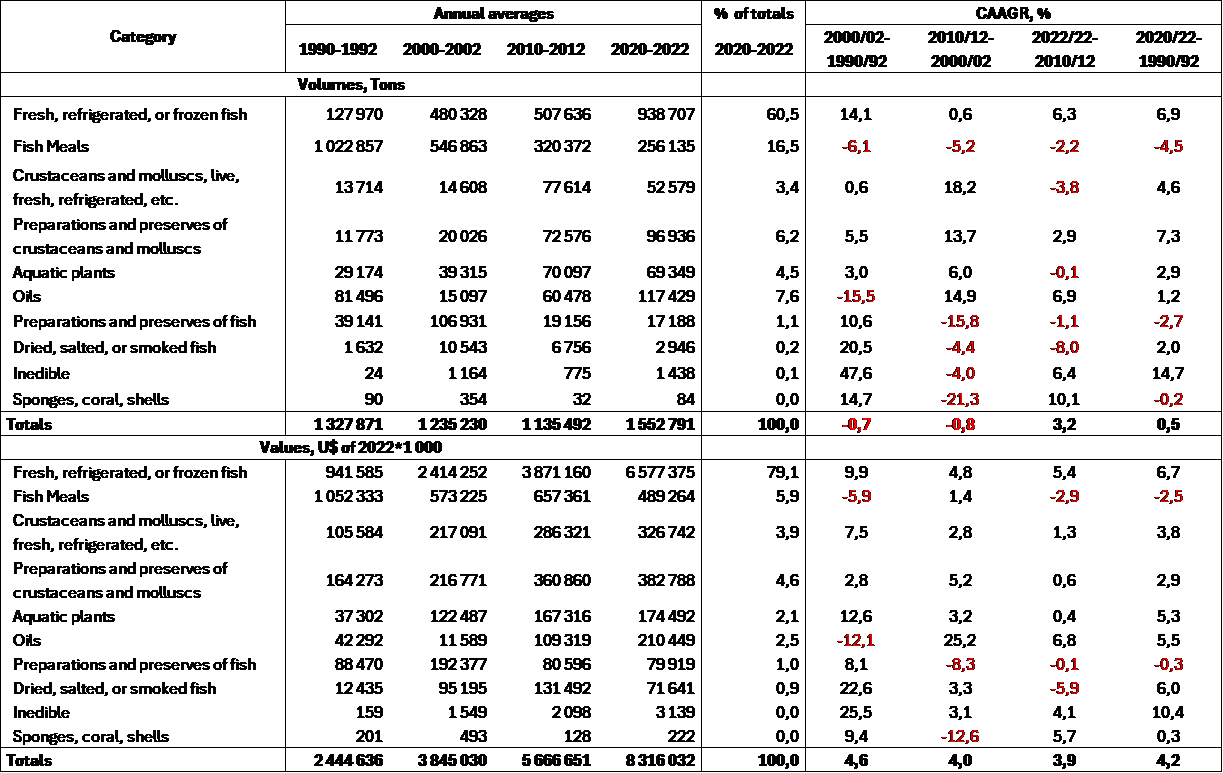

In a country focused on fisheries exports, the sharp declines in extractive fishing volumes and increases in aquaculture harvests over the past three decades have also been reflected in sectoral foreign trade.

Thus, annual exports increase between 1.33 and 1.55 MMT in volume terms (16.9% between 1990-1992 and 2020-2022), but by a significant 240.2% in their annual values (2.4 to 8.3 MM of U$ of 2022) between the same dates (Table 7), basically due to the growth in salmonid sales abroad. Therefore, export volumes increased with a CAAGR of 0.5% in volume and 4.2% in value terms in this period.

Increases of almost 600% in value terms for fresh, chilled or frozen fish is the main result of salmon and trout sales progress. In turn, the 210% growth experienced in exports of molluscs and crustaceans fresh, chilled or frozen is attributed mainly to mussels. The most notable decreases in sectoral exports affect fish meal, with values falling from US$ 1,052 million in 1990-1992 to US$ 489 million in 2020-2022 (53.5%), due to falls in catches of small pelagics as well as growing domestic demand to locally produce balanced fish feed.

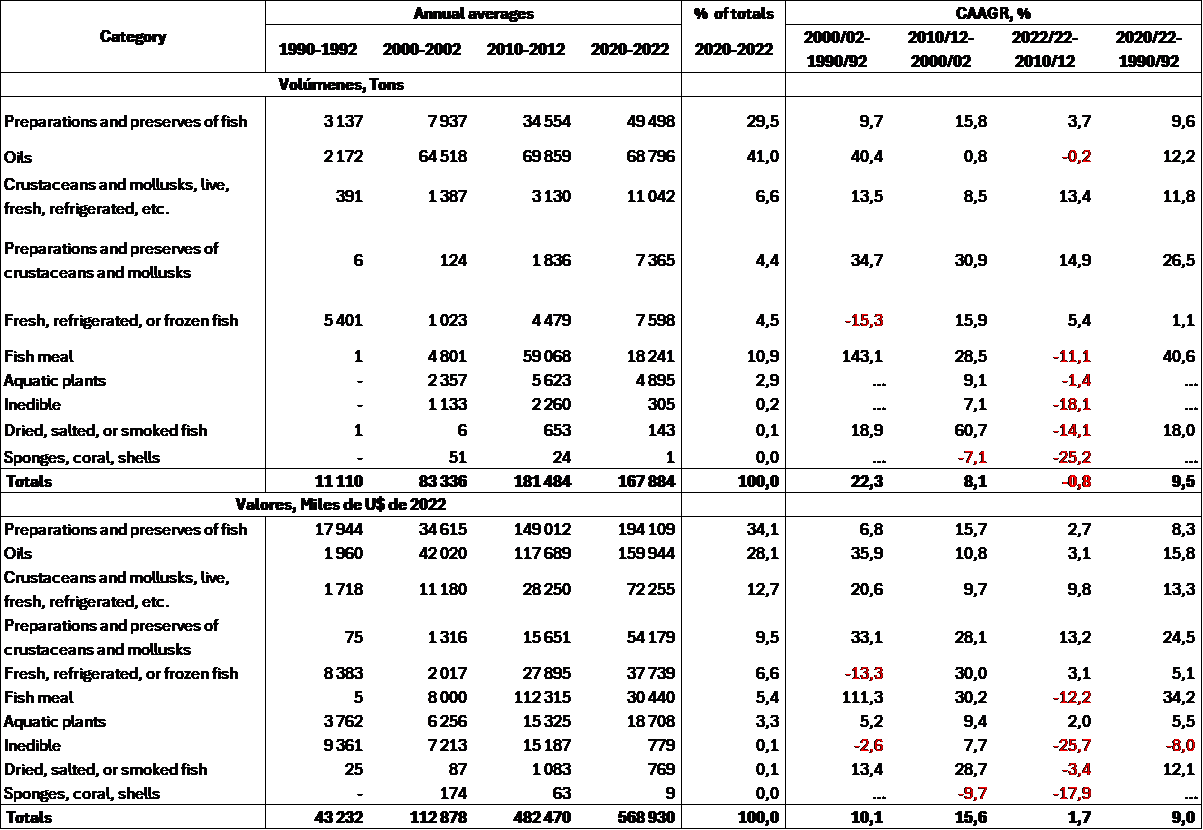

Como se ha señalado, el pobre abastecimiento del mercado doméstico se ha traducido en niveles y valores de importaciones crecientes en los últimos 30 años (Tabla 8), con aumentos en volumen desde 11,1 a 167,9 M de tons ( 1.411%) en el período ya detallado, y valores entre 43,2 y 568,9 millones de U$ de 2022 (1.216%). Estas cifras incluyen cantidades crecientes y significativas de aceite y harina de pescado, residuos y de otras especies, que en 2020-2022 significan un 52% del volumen y un 33% del valor anual importado. De cualquier forma, ya se importan también unas 50 M tons de conservas de pescado anuales en 2020-2022, buena parte de las cuales corresponden a atún; unas 11 M tons de crustáceos y moluscos frescos, refrigerados o congelados, con una alta participación de camarón ecuatoriano; 7,6 M tons de pescado anual en la misma presentación, y 7,4 M tons de conservas de moluscos y crustáceos, en una gran variedad de productos, todos para consumo humano directo.

[1] Subsecretaría de Pesca y Acuicultura, 2024. Estado de situación de las principales pesquerías chilenas, año 2023

Table 7 Chile: Exports of the fishing sector by main items and indicators between 1990-1992 and 2020-2022

Source: Calculations of the study on Fishstat figures, FAO, 2024

Table 8 Chile: Fishery product Imports by main category and indicators,1990-1992 to 2020-2022

Source: Calculations of the study on Fishstat figures, FAO, 2024

Tuna is not caught in Chile and shrimp neither tuna are locally farmed, and therefore they supplement other species and products that years ago were more plentifully available . These figures, although still relatively moderate, speak for themselves of the possibility of increasing national production for the domestic market, especially through farming, since traditional coastal fishing / wild mollusc’s extraction do not seem to have opportunities for significant developments in the foreseeable horizon, with products within the reach of most Chilean consumer.

Even if the surplus of sectoral foreign trade is very significant (some U% 7,747 MM per year in 2020-2022), it is no less true that the evidence of the need to increase domestic supplies, particularly with artisanal farmed production for human consumption, is again reinforced.

It is noteworthy that in 1990, aquaculture accounted for only 2.2% of the volume and 16.8% of the value of sectoral exports, while in 2022 is responsible for 56.8% of volumes and 81.3% of exported values. SERNAPESCA figures for 2023 indicate that these shares decrease to 54.6% and 79.3%, respectively. Figures imply as well that aquaculture exports show an average FOB value per kilo of U$ 7.7, while extractive fishing products are only worth U$ 2.4.

Finally, sectoral exports (fishing plus aquaculture) represent 9% of the total value of the country's exports of goods in 2022, and 9.5% in 2023, with aquaculture corresponding to

a 7.3% and 7.5% of these national totals, respectively, occupying a second place as exportable goods of the country in recent years and also validating from this point of view the importance of this activity.

GOVERNANCE AND OUTLOOK

The Chilean fishing sector has been the subject of great changes in recent decades. Among some notable sectoral situations, the following could be highlighted:

- A sharp decline in the largest pelagic fisheries in the country, especially anchovy, common sardines and horse mackerel, responsible for the main losses in national landing, accompanied by significant decreases in the catch of hake and in almost all other coastal fishing items, despite increases in the catch of cuttlefish and a few other species (pomfret/’reineta’) in some periods. Beyond the drop in the catch of hake, other 'white' fish species are also declining and practically disappear from the table of Chilean consumers, such as the red and black conger eel, meagre and local soles.

- The emergence and enormous development of commercially oriented farmed products, especially salmonids and mussels, which, as mentioned, occupy solid second places in the world after Norway and China, respectively. These crops boost the country's fish exports well above the previously existing limits, and allow for significant regional development, especially in the southern part of the country, and

- Within this sector, artisanal fisheries and aquaculture are the activities that have developed the most in the last 30 years. In the former case volume increases are strongly linked to a limited number of pelagic fish and cuttlefish, with the first ones mainly used to produce meals. In the case of fish and cuttlefish, though, this occurs more at the expense of their previous capture by the industrial sector than due to net increases in extraction volumes.

Thus, while industry has decreased its fishing volumes by 69% in the last 20 years (2001-2003 to 2021-2023), artisanal activity has increased by 42%, especially with algae, cuttlefish, pomfret / ‘reineta’ and pelagic fish. Chilean fishing activity in international waters - included as industrial fishing - is also quite significant, and in 2023 reaches almost 125,000 tons, basically of horse mackerel, mackerel and krill (115,000 tons in 2022, with the same main species) and it is highly likely that these catches can increase in the future, if the necessary investments and equipment are made available, and regulations in international waters are reasonable and do not constraint national interests.

In any case, sectoral activities continue to focus mainly on exports, while the domestic market remains poorly supplied. The sectoral export vocation determines the need for companies with great production capacities, highly technical and competitive. These characteristics, though, which place Chile among the main fish exporters in the world, do not necessarily impact the supply of domestic consumption, which having a second level of hierarchy, receives less attention from industry, the State and even, consumers.

This fluctuating panorama has become even more complex recently, with the imminence of the enactment of new sectoral laws, this time, separately for extractive fisheries and for aquaculture. The discussion of these proposals by the current Government is taking place in Congress, and it is not yet possible to predict their date of enactment or their final content. To this end, the Government has held a good number of regional group meetings and encounters with different organizations of workers, employers and other agents, and it is already clear that there are strong disagreements between the various actors, a situation that will obviously delay and/or complicate the legislative process. At present, strong tensions prevail over possible reductions in industrial fishing rights, in favor of small-scale fishing, an issue that if approved, could generate substantial changes in the country's industrial fishing structure.

In this last sense, and highlighting some of the existing conflicts, the fisheries bill indicates textually that: '... In this regard, we must remember that Law No. 20,657 of 2013 established a division by fishing units between the artisanal and industrial sectors, which was harshly criticized for the arbitrariness of the distribution throughout the national territory between both sectors. Part of the focus on equity, in addition to scientific and oceanographic criteria, lead us to rethink this fractioning in this new proposal, as detailed below. It is crucial to guarantee territorial equity, offering fair treatment to all coves and their communities throughout the country, as well as to ensure equity in the conditions of social protection for artisanal fisheries. Finally, gender equity must be emphasized, recognizing and valuing the vital role of women in the fishing sector.'

Thus, the bill proposes that 50% of the hydrobiological resources assigned to the industrial sector be tendered, a figure that contrasts with the 15% that is currently used, a situation that challenges the claimed 'historical rights' that were considered in the text currently in force. Likewise, the text would limit the percentages of allocation of industrial fishing rights for participants in the auctions, in order to – it is said – guarantee greater and better levels of competition in the respective fisheries, issues that added to several other considerations speak of a profound destabilization of large-scale industrial work.

Likewise, aquaculture, especially salmonids farming, faces a strong and systematic controversy with authorities and environmentalist organizations, which has completely stopped the allocation of new marine concessions and prevented the relocation of others. Added to these facts is the paralyzing effect of the so-called Lafkenche Law (Law No. 20249 of 2008), which claims the right of exploitation of huge portions of the coastal zone by the native (‘original’) populations, jointly limiting the possibilities of aquaculture and even artisanal extractive work. Here, if applications for ECMPO (coastal marine spaces for indigenous peoples) are submitted and these are superimposed on applications from third parties in process, the former have preference over the latter, and consequently any possibility of use of the requested areas for farming (or, where appropriate, for fishing) is paralyzed, until the existence or not of a customary use is verified. The corresponding study should take no more than a year, but it has taken up to 4 years, postponing the decision making process.

In the case of farming diversification, there has been significant help from the State through CORFO to promote the work with new species and technologies. This support is complemented by financial contributions from the private sector. In these matters a rule that seems to be almost universally valid is complied with, implying that it takes 10 or more full years - without considering the development of new markets and the likely regulatory readjustments that are needed to facilitate or give viability to these new farming projects - to obtain results of commercial interest in new farming techniques, for new species, starting from their initial phases, as is happening in the case of yellowtail kingfish, red conger eel and/or meager, and offshore practices, among others. This did not happen with salmon, trout nor mussels, since the respective farming technologies were brought directly from abroad and only adapted to the national reality. Nowadays, when diversification processes in Latin America are mostly concerned with native species, for which, generally speaking there are no farming technologies available, or they have not been completed, the innovation process is costly, time consuming and difficult to be materialized in the most relevant aspects, therefore delaying or altogether inhibiting the expansion of the production matrix. Additionally, it is very likely that various native species lack broad markets beyond their immediate surroundings, a fact which does not guarantee economies of scale in production to ensure their economic viability. Alternatively, significant financial resources and considerable periods of time may be required to promote their introduction in other countries and/or consumer hubs, where demand could reach higher volumes and values of greater interest.

There is still also a lower relative importance assigned by the public sector to aquaculture, since it generally concentrates a large part of its resources, personnel and dedication to address the problems of traditional fisheries. In Chile it is particularly noticeable a lack of support for small-scale aquaculture producers, who after a long wait since 2003 for a statute that would facilitate their work, has seen a new regulation emerge only in 2021, which will probably not modify the status of these producers but marginally, missing a historic opportunity to promote their controlled production and generate stable work and well-being in several regions and rural areas of the country, while improving the supply of fishery products in the domestic market.

All these situations speak of a complex and uncertain outlook for the development of fisheries and aquaculture in the near future, especially in large-scale projects, which contrasts with the ample natural conditions and possibilities to develop competitive activities in an area that is important to the economy and exports, employment and job creation along the country. This uncertainties in fishing will increase with the presentation of the new law for aquaculture, so in the coming years it should not surprise if new investments are delayed, and/or even sectoral divestment occur, with implications difficult to predict in more detail for now.

The proposed measures in the draft fisheries law and those to be presented for aquaculture will clearly seek environmental sustainability. As well, in the case of fishing, there is a marked bias in favor of the artisanal fishing sector, which will affect industrial-level activities and their future investments. At the same time, the opinions of environmentalists and government groups could generate a legislation proposal for aquaculture where principles different from those of the business sector prevail, a fact which will also generate an unfavorable environment for the development of large or middle size activities. It is also probable that the new aquaculture law applicable to small-scale farmers to improve their prospects and combat negative effects of climate change will not produce meaningful results while in parallel not sufficient attention will be given to disruptive technological changes (farming in recirculation and/or in high-energy marine areas, among others), to which Chile will have to adhere, under penalty of losing competitiveness and markets such as those of China, the United States, the European Union, Japan and Brazil, etc.

In all, it is possible to imagine that a process of mergers and/or acquisitions of companies between aquaculture producers might take place, and a low if not zero growth rate in large-scale farming could prevail, added to the inability of small-scale aquaculture to develop and better meet domestic demand. Local entrepreneurs might also turn to investing in other farming activities in the rest of Latin America (perhaps in shrimp and tilapia, as well as in the production of salmonids with land-based recirculation systems) or in countries with a higher level of development, to take advantage of the know-how and surpluses accumulated along many years of hard work.

It can neither be ignored that aquaculture is currently over regulated, although with ineffective controls, resulting in losses in competitiveness, conflicts and less efficiency associated with the growing difficulties of industry in directing and promoting their activities with the necessary degrees of independence from the State, energy and creativity. In turn, the State organization is inappropriate with regard to the needs of this industry, especially with regard to aquaculture. As mentioned, the granting of new concessions, particularly for salmon farming is extremely complicated and ineffective, while industry requires a different and better dynamic, in a highly competitive world, where Chile develops its fishing/aquaculture sector with a clear export vocation, an orientation that this far has given it its best moments.

Clearly then, an industrial sector of notable extractive fishing development until the 1990s is currently slowing-down its pace, without being able to stabilize its work or make transcendental investments, and artisans, with regulations that have been gradually favoring them, follow a development course with a limited number of species, and decreases its relevance in the domestic supply of 'fresh' fish. This occurs in the face of manifest, growing and very well structured competition with poultry and pork suppliers, who currently enjoy a good reputation, offer well-standardized products, available all year round, thus systematically gaining greater acceptance from local consumers.

Likewise, national aquaculture, extraordinarily effective until the beginning of this century, has begun a process of progressive slowdown in recent years, mainly as a result of the impact of recurrent diseases and improper governance, generating uncertainty about its future, which otherwise should be very promising both with current species farmed, and based on a much more diversified productive grid starting as from the next decade, which this time must also accommodate new and important efforts in the north-central and northern areas of Chile.

Thus, and despite the undeniable potential of the country, this accumulation of questionable situations generates doubts about the direction that fishing and aquaculture will take in the near future, although if part of the conflicts and limiting situations are resolved, at least aquaculture should develop more quickly.

In any case, if just over thirty years ago Chile was basically a fishing country, today it can be said with pride that the country fish and farm at the same time and maintains outstanding positions worldwide in both activities. The country should be able to preserve and improve its situation in the future, based on local natural conditions, a brave and capable workforce and business, and a State that, while having to regulate and administer, must also assume with energy and conviction the necessary leadership to define the new and better directions for these noble activities.

[1] SERNAPESCA : Servicio Nacional de Pesca y Acuicultura

[2] Cifras de este párrafo obtenidas de los Informes Sectoriales de la Subsecretaría de Pesca y Acuicultura en 2024

Oficina Central: Ciudad de Panamá, Panamá

Oficinas de representación: Chile, Ecuador, EE.UU. de N.A., México, Australia y Noruega

CONSTRUYENDO UN FUTURO AZUL…..