LA ACUICULTURA MUNDIAL EN AÑOS RECIENTES: REALIDADES Y PERSPECTIVA MUNDIAL Y LATINOAMERICANA/DEL CARIBE

DESCARGAR / Download

WORLD AQUACULTURE IN RECENT YEARS: GLOBAL AND LATIN AMERICAN/CARIBBEAN REALITIES AND OUTLOOK

Carlos Wurmann G

President of CIDEEA

International Centre for Strategic Studies in Aquaculture

December 2024

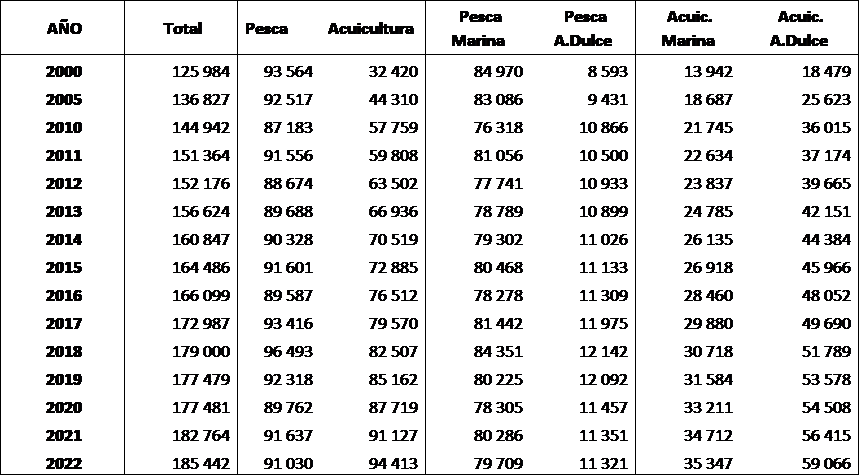

OVERVIEW

For the first time in history, global aquaculture production in 2022 exceeded extractive fishing volumes! With 94.4 million tons, valued at $295.7 billion (farm-gate value), it surpassed the 91 million tons of fishing, accounting for 50.9% of the total landing volume of 185.4 million tons, excluding algae. Here, aquaculture continues to grow at an average annual cumulative rate (CAGR) of 4% in the decade ending in 2022, compared to a virtually stagnant fishing situation, with an CAGR of only 0.3%. In that same year, total algae landings rose to 37.8 million tons.

Board 1

World fishery production, 2000-2022

Fuente: FAO, Fishstat, 2024

With 59.1 million tons and 62.6% of volume totals, continental aquaculture continues to lead in 2022, as marine harvests amount to only 35.3 million (37.4% of totals). These figures exclude farmed aquatic plants, which amounted to a significant 36.5 million tons in 2022, with a first-sale value estimated at $17 billion.[1]

Since 1990, total extractive fishing has only shown a slight trend to increase (statistically not different from zero) by approximately 114 thousand tons annually, mainly due to a significant upward trend of 192 thousand tons annually in continental fishing and decreases of about 78 thousand tons annually in marine fishing (non-significant figure).

[1] All values are expressed in US dollars of 2022, using the US wholesale price index for all products as deflator. Additionally, unless otherwise stated figures exclude algae from either wild environments or aquaculture

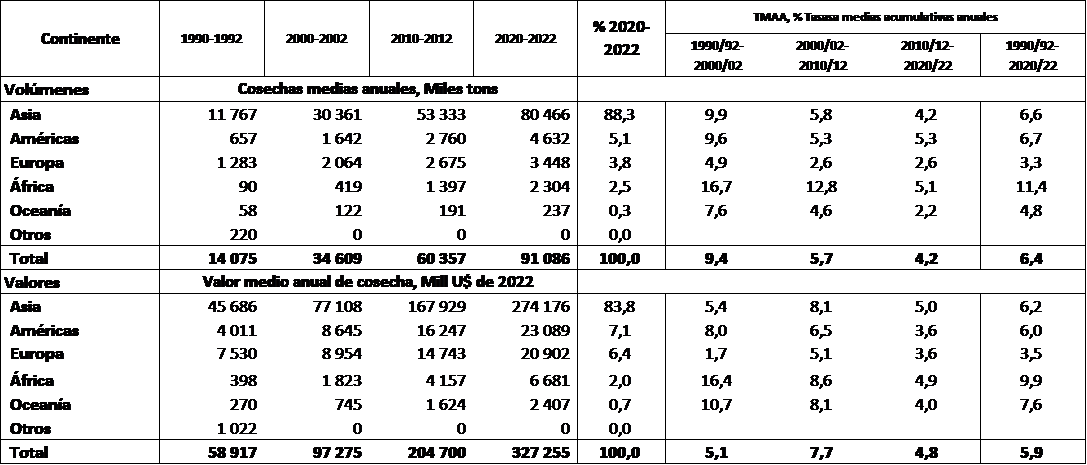

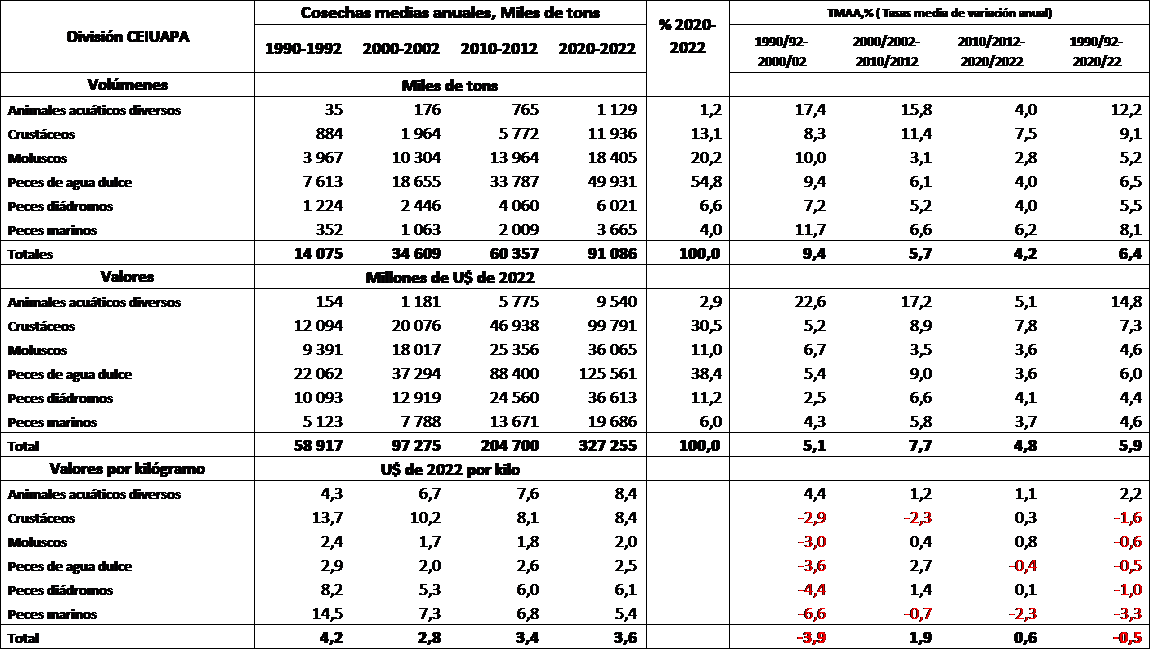

Board 2

Volumen y valor de la producción acuícola mundial por continente, 1990-2022 y tasas de variación medias acumulativas anuales, TMAA, %

Source: Calculations of the study on Fishstat figures, FAO, 2024

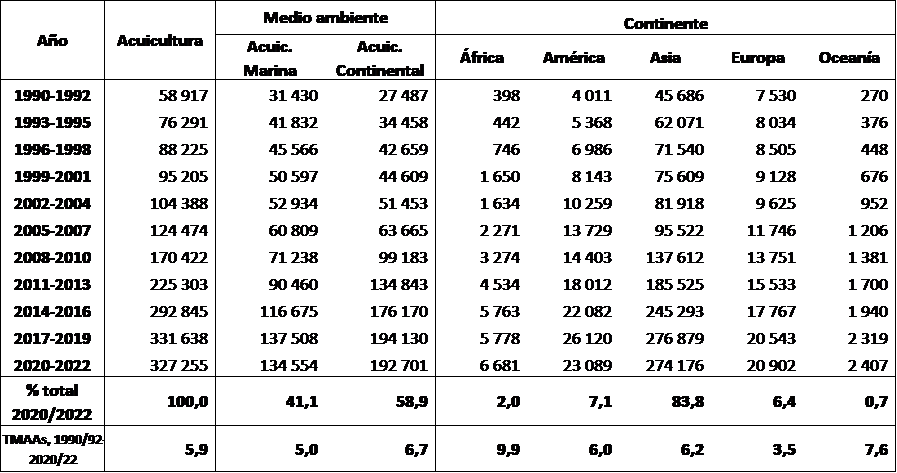

Harvests’ growth rates between 2010/2012 and 2020/2022 are led by the Americas (CAGR of 5.3%), compared to 5.1% in Africa, 4.2% in Asia, and only 2.6% in Europe. los volúmenes de la acuicultura de ALC destacan por su velocidad de crecimiento de 6,4% anual entre las mismas fechas.

Igualmente, la velocidad de crecimiento de los volúmenes de cosecha acuícola por continente y región disminuyen sistemáticamente en los últimos 30 años, con una TMAA de 9,4% para los volúmenes entre 1990/1992 y 2000/2002 y sólo un 4,2% entre 2010/2012 y 2020/2022. En términos de valores de primera venta (‘ex granja’), las cosechas totales aumentan de valor medio anual desde U$ 58.917 MM en 1990-1992 hasta U$ 327.255 MM en 2020/2022 (TMAA de 5,9%).

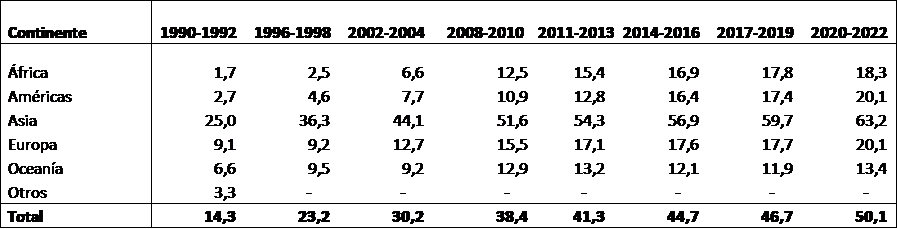

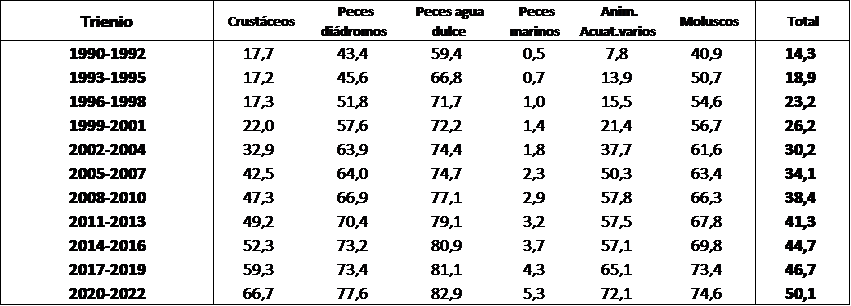

The incidence of aquaculture varies in different continents but grows systematically over time, reaching 50.1% of total landings worldwide in 2020/2022, 63.2% in Asia, and only 13.4% in Oceania. In the remaining continents, contributions are close to 20%, suggesting that further development could still be achieved in various regions of the world.

Tabla 3

Incidencia de la acuicultura en el volumen de desembarque, por continente, 1990/2022

% de lo desembarcado

Fuente: Cálculos del estudio sobre cifras FAO, Fishstat 2024

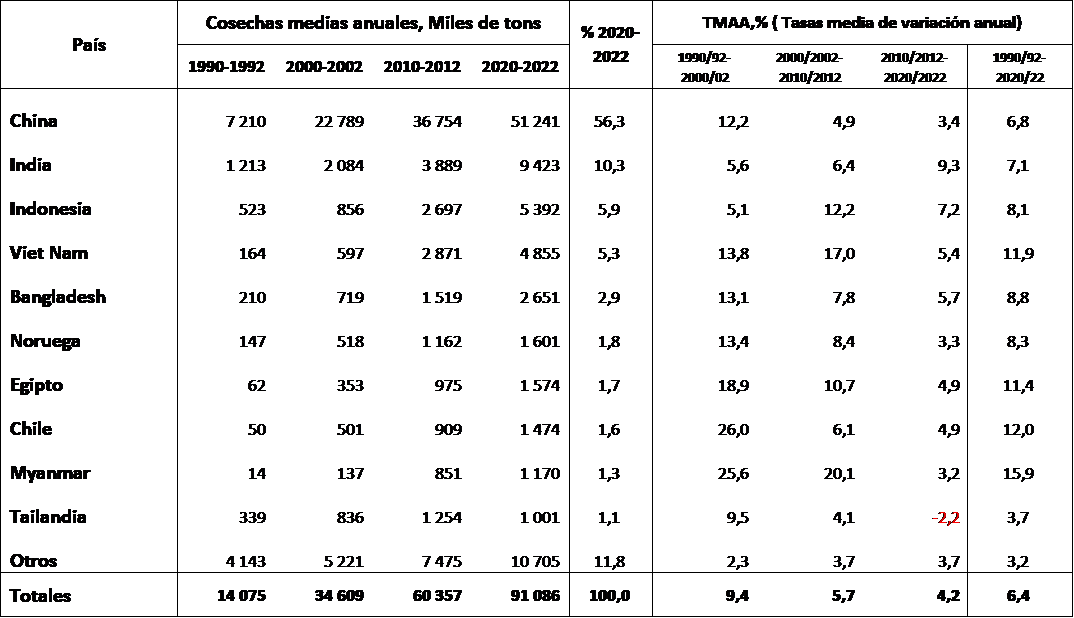

Despite its extraordinary achievements over the past 40 years, global aquaculture remains in its infancy in most countries and is highly concentrated in five Asian countries, with China clearly standing out as the leading producer. These five countries (China, India, Indonesia, Vietnam, and Bangladesh) contributed 81% of the volumes and 76% of the values of global harvests in 2020/2022. Altogether, only 11 countries exceed one million tons farmed in 2022.

Additionally, out of the 213 countries/territories with statistical records in FAO over time , only 197 recorded harvests in 2020/2022. Among these, 69 produced less than 1,000 tons per year, and another 22 harvest between 1,000 and 10,000 tons annually in 2022. These two groups, constituting 46% of countries or territories reporting crops, account for only 0.24% of 2022’s harvests. The next 40 countries, with harvests between 10,000 and 100,000 tons annually, account for only 1.4% of the cultivated production that year. Finally, 30 countries with harvests between 100 thousand and 1 million tons contribute 10.2% of production, while those with 1 MMT and over are responsible for 88.2% of farmed production. There is no doubt , then, that global aquaculture has significant room for growth, whether by enhancing production in the most successful countries or by fostering development in regions where fish farming is minimal or nonexistent.

Several LAC countries stand out in the global aquaculture scene. Chile is the 8th largest aquaculture producer in the world in terms of volume in 2020/2022; Ecuador ranks 11th, Brazil 13th, Mexico 21st, Colombia 28th, and Peru 31st.

With 51.2 million tons, China accounted for 56.3% of world harvests in 2020/2022, and Asia as a whole, with 80.5 million tons, contributed 88.3% to totals, followed by the Americas (4.6 million tons; 5.1%) and Europe (3.4 million tons: 3.8%), with Latin America and the Caribbean (LAC) contributing 4.0 million tons and 4.4% of these productions.

As well, China shows diminishing growth rates in farmed production over the decade ending in 2020/2022 due to its explicit strategy more concerned on long-term sustainability and the effects of excessively massive and geographically concentrated productions. India follows China in aquaculture production with 9.4 million tons (CAGR of 9.3%) during the same period. Next are Indonesia, with 4.9 million tons (CAGR of 5.4%), and Bangladesh with 2.7 million tons (CAGR of 5.7%). The remaining five countries completing the top 10 positions in global harvest volumes in 2020/2022 show average annual productions of less than 2 million tons in that triennium and CAGRs below 5% in the decade ending in 2020/2022. Thailand, in turn, shows a negative annual growth rate of -2.2% in this same period.

Among the top 10 producers, Myanmar, Chile, and Egypt achieve annual growth rates above 10%, with Norway, Egypt, and Chile being the only Western countries in this important position.

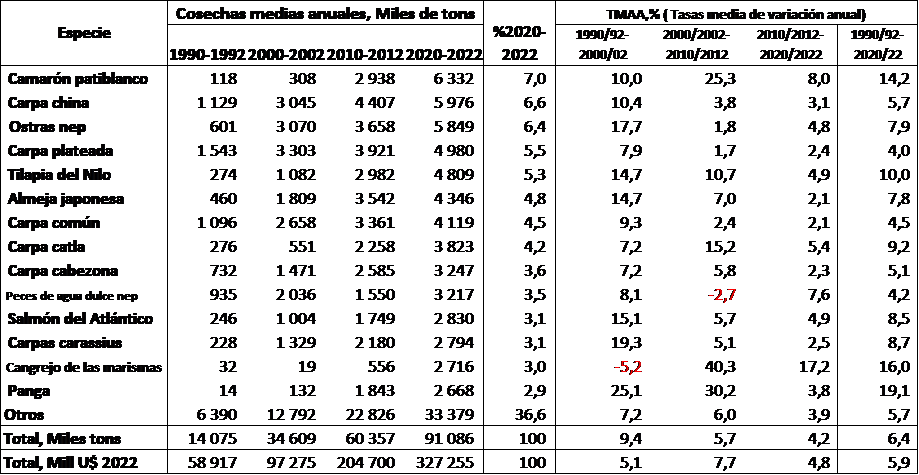

In terms of species, excluding algae and various products such as shells and others, freshwater fish continued to lead global harvest volumes during 2020/2022 (54.8%), followed by molluscs (20.2%) and crustaceans (13.1%), with smaller shares from diadromous fish (6.6%), marine fish (4%), and various aquatic animals (1.2%).

With 6.3 million tons Ecuadorian shrimp leads among farmed species (or groups of species such as 'various unspecified marine and/or freshwater fish') listed by the FAO in 2020/2022, followed by Chinese carp with 6 million tons, unspecified oysters with 5.8 million tons, silver carp with 5 million tons, and Nile tilapia with 4.8 million tons. These top 5 species account for 30.7% of the triennium's harvests, while the top 10 species produce 51.3% of the crops, showing that global aquaculture production is more concentrated in terms of countries than species. In terms of species, it is necessary to accumulate the crops of the top 27 ones out of the 505 listed in 2020/2022 to reach 80% of the world's aquaculture harvests.

[1] Cifra basada en el análisis de la base de datos FISHSTAT, 2024

Tabla 4

Volúmenes de cosecha de países principales en la acuicultura mundial, 1990-2022 y TMAAs, %

Fuente: Cálculos del estudio, sobre cifras FAO, Fishstat, 2024

Tabla 5

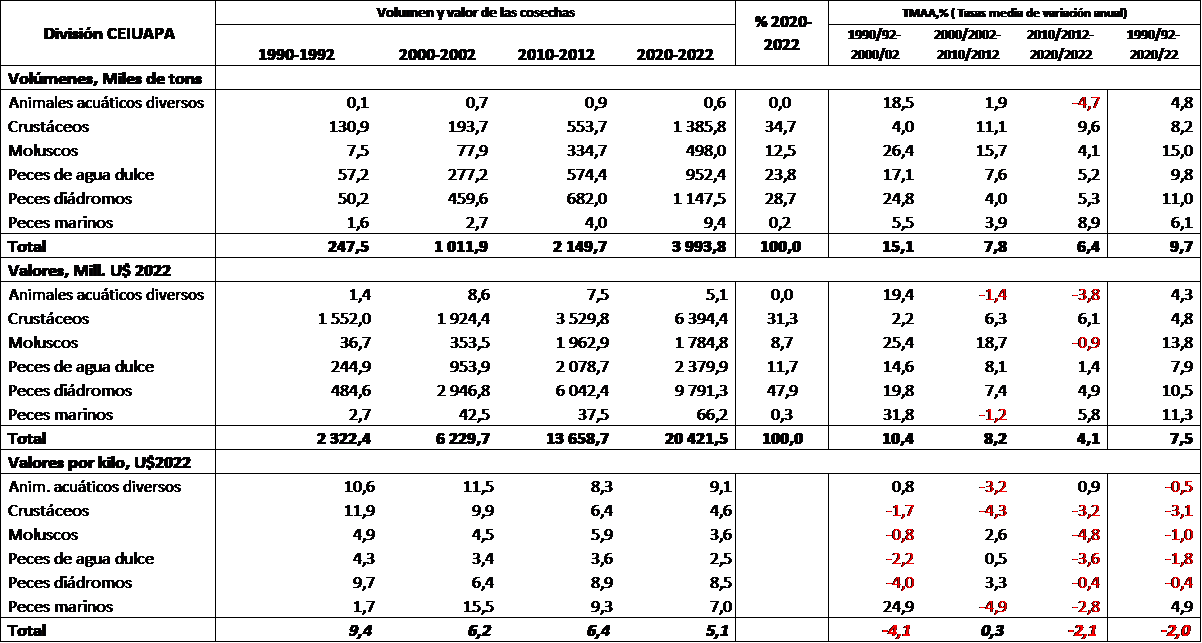

Volúmenes, valores de primera venta y valores por kilo de las cosechas mundiales de las divisiones CEIUAPA de especies, 1990-2022 y TMAAs

Fuente: Cálculos del estudio, sobre cifras FAO, Fishstat, 2024

Nota: No se incluyen algas

Tabla 6

Aporte de la acuicultura al desembarque mundial de las diversas divisiones de especies CEIUAPA,

2000-2022, % del desembarque de cada división y del total

Source: Calculations of the study on Fishstat figures, FAO, 2024

It is remarkable that, except for farmed marine fish (3.7 million tons annually in 2020/2022), which accounts for only 5.3% of their global landing of 69.8 million tons, the other FAO ISSCAAP divisions (crustaceans, diadromous fish, freshwater fish, marine fish, molluscs and miscellaneous aquatic animals), farmed products account for 67% or more of total landing in each of these categories in 2020/2022. These figures indicate that farming accounts for 50.1% of the landing in 2020/2022 (50.9% in 2022), an extraordinary situation that demonstrates the vast and mounting reach of farming in global fish supplies, except, as indicated, for marine fish. Nonetheless, over the last 30 years farmed marine fish show a CAGR of 8.1% for volumes, higher than those for other divisions - except crustaceans - in the decade ending in 2022, with an annual value of 6.2%.

As noted above, Ecuadorian shrimp (P. vannamei), with 6.3 million tons annually in 2020/2022, leads the top 10 species in global harvests, followed by a series of freshwater fish (various carps and Nile tilapia), along with several oysters and the Japanese clam, all of which have production above 3 million tons annually in the triennium. Additionally, in the decade ending in 2020/2022, CAGRs for farmed marsh crabs (17.2%), Ecuadorian shrimp (8%), and unspecified freshwater fish (7.9%) stand out. Likewise, several of the other main farmed species show production increases above 10% annually over the last 30 years, although there is a clear trend towards moderating these figures over the years.

Tabla 7

Principales especies de la acuicultura mundial, según su orden en 2020-2022

Miles de tons y TMAAs en % para 1990-2022

Fuente : Cálculos del estudio, sobre cifras FAO, Fishstat, 2024

Tabla 8

Valores totales ‘ex granja’ de la acuicultura mundial por medio ambiente y continente,1990-2022

Millones de U$ de 2022 anuales y %

Fuente: Cálculos del estudio sobre cifras FAO, Fishstat 2024

Nota: en 1990/1992 no se incluye el valor parcial para ‘otros países’, que perteneciendo a la ex URSS o Yugoslavia luego fueran incluidos en sus continentes respectivos. La cifra total, si incluye dichos valores.

The total 'ex-farm' values of aquaculture harvests over the last 30 years ending in 2020/2022 also grow strongly (CAGR of 5.9%), although proportionally less than volumes (6.4%), resulting in lower ex-farm values per kilo of global harvests ( USD 3.6) than those of 1990/1992 (USD 4.2). Nevertheless, they have been systematically recovering over the last decade.

The first-sale values of continental crops represent only 58.9% of global harvest values in 2020/2022, compared to 62.2% in terms of volumes. In the case of Asia, the world's main producing region, harvests contribute 88.3% to volumes, while they account for only 83.8% of global values, because of lower average ex-farm values per kilogram, the second lowest among continents, surpassing only Africa. Nevertheless, China on her own contributes 59% of global harvest values in 2020/2022 (56.3% of volumes), 73% of which are associated with continental aquaculture products.

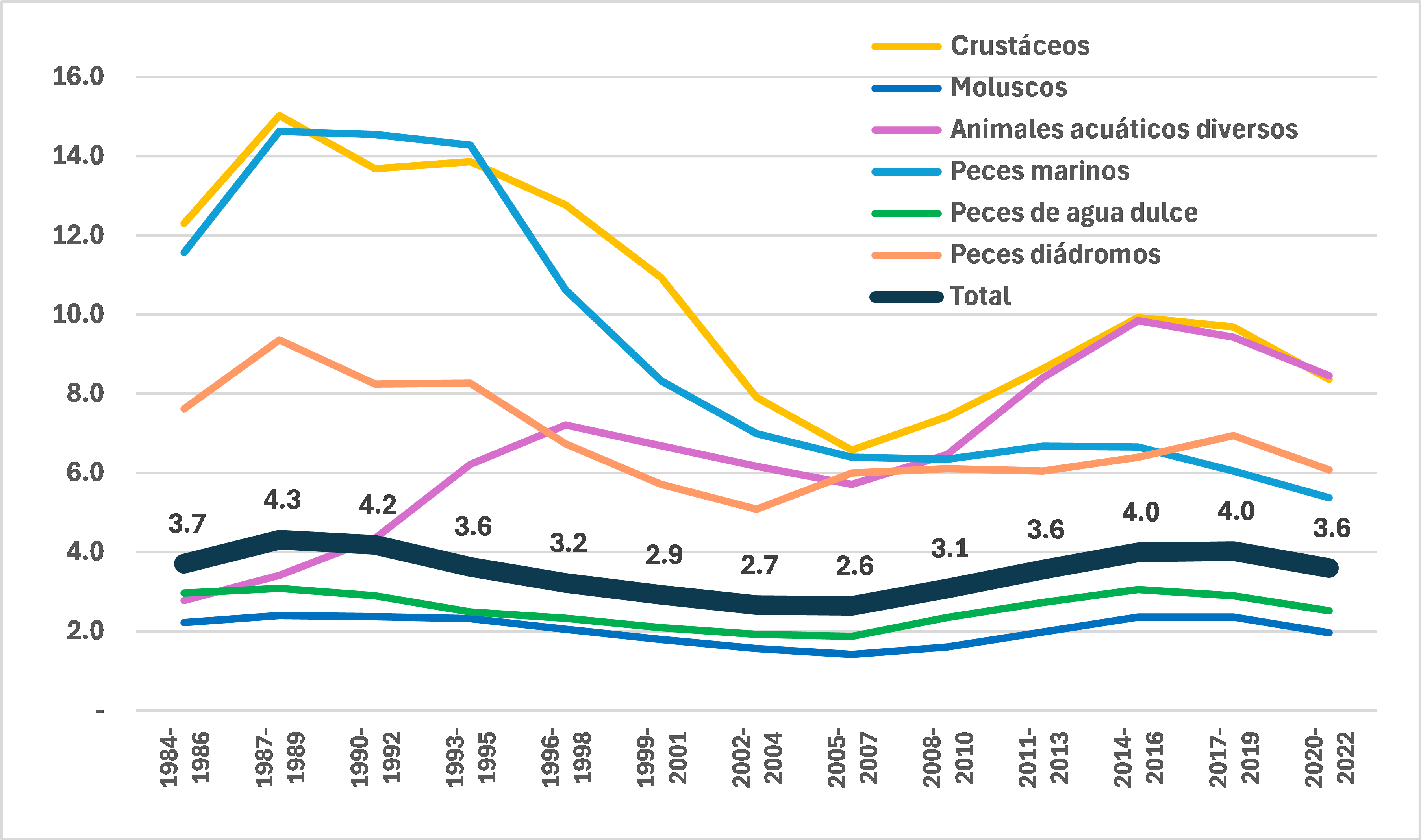

Given the above figures, the average first-sale values per kilogram of global aquaculture is 3.6 USD/kg in 2020/2022, with peaks of 8.4 USD/kg for crustaceans and various aquatic animals. However, the significant relative participation of freshwater fish and mollusc harvests, both of lower value (2.5 and 2.0 USD/kg respectively), heavily reduces the average unit price of global aquaculture crops. Both species divisions also experience declines in growth rates in the 1990s and over the average of the last 30 years.

Technological and other limitations persist with marine fish farming, hindering efforts to increase their cultivation efficiently and to enhance production. As it is known, the development of cultivation technologies commonly require at least 10 to 15 years of well-planned R&D work at very high costs, a fact which complicates these efforts and industry progress. Additionally, few private companies can finance these efforts independently, often necessitating systematic public-private partnerships to achieve commercially viable results.

Overall, the figures for 2022 reinforce the conviction that future demand for fish and fish products must primarily be met through increases in aquaculture harvests, although improvements in management systems, reduced post-harvest losses, better control of illegal and unregulated fishing, and fewer discards in extractive fishing processes could also contribute to increasing future supply, albeit to a much lesser extent. Similarly, consideration could also be given to the incorporation of unconventional fish species not yet commercially captured, with still unpredictable outcomes. In any case, recent global catches in the range of 90 to 96 million tons annually, a figure similar to that for the 1990s, are indicative of stabilized extraction levels that do not appear to have significant growth potential except through the aforementioned approaches. Indeed, the latest version of SOFIA 2024 confirms serious concerns about the status of exploitation of traditional fishery resources and indicates that the fraction of marine resource stocks captured/extracted at sustainable levels in 2021 is only 62.3%, 2.3% lower than in 2019.

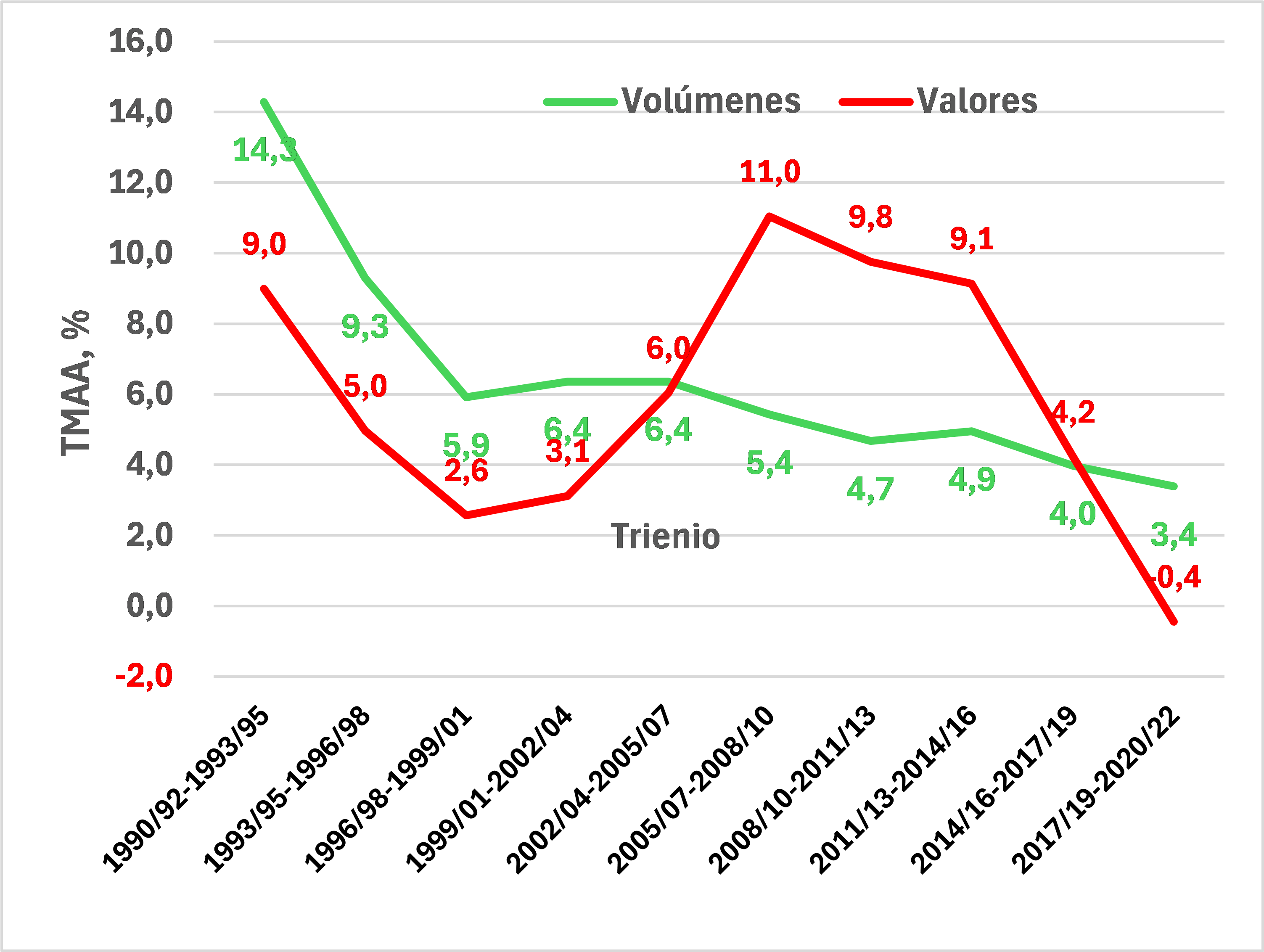

Meanwhile, annual growth rates of global aquaculture volumes and values remain positive and exceed those of global population variation. However, triennial growth rates of harvest volumes have clearly declined between 1990/1992 and 2020/2022, with the exception of the 1999/2001 to 2005/2007 period. First-sale value growth rates show increases until the 2014/2016-2017/2019 period, followed by a decrease for the first time between 2017/2019-2020/2022 (with a compound annual growth rate of -0.4%).

[1] FAO, 2024. SOFIA, The State of World Fisheries and Aquaculture. Roma

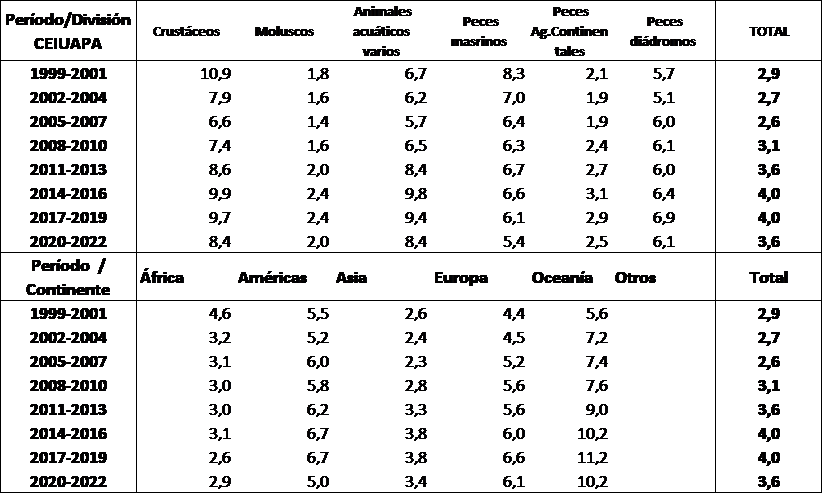

Tabla 9

Precios de primera venta por kilo de los productos de la acuicultura mundial, por continente y división de especies CEIUAPA, 1999-2022 Valores referenciales de FAO en U$ de 2022/Kg.

Source: Calculations of the study on Fishstat figures, FAO, 2024

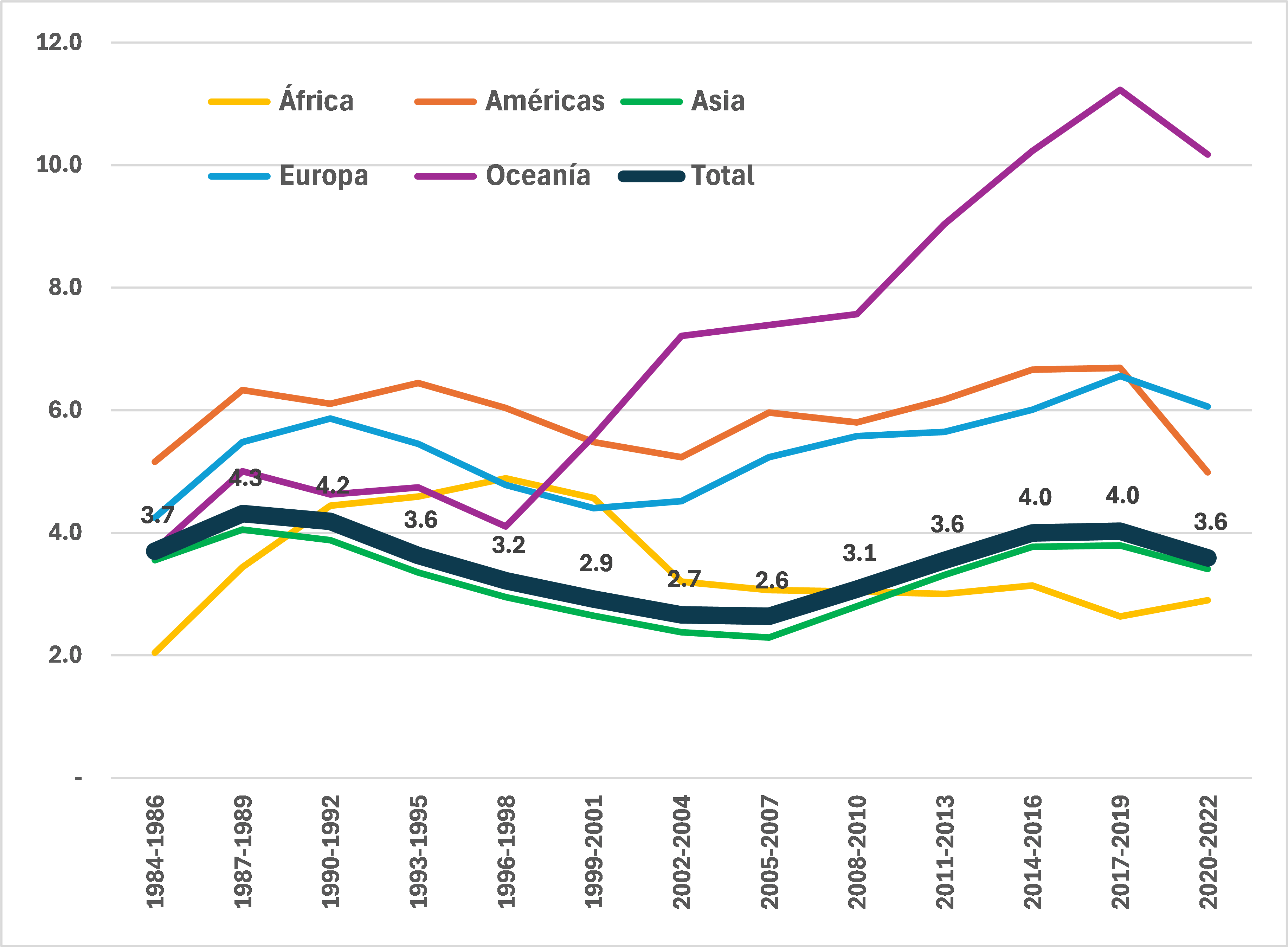

As mentioned, the average first sale prices per kilogram of aquaculture harvests vary significantly over time between continents and also by ISSCAAP division. The highest average monetary values in 2020/2022 are observed in Oceania, which, with a modest volume of crops, presents annual average prices of USD 10.2 per kg, based on a very selective production matrix. It is followed by Europe, a continent with low aquaculture production dynamics, showing local harvest prices of USD 6.1 per kg per year in the same triennium. The Americas record first-sale values of USD 5.0 per kg (with Latin America and the Caribbean registering an average of USD 5.1 per kg), Asia at USD 3.4 per kg, and Africa at USD 2.9 per kg. Additionally, global average prices have fluctuated over time, with periods of increase and decrease, maintaining a minimum annual average level of USD 3.6 per kilogram since 2011/2013.[1]

Except in the case of diadromous fish like salmon, where average first-sale values per kilogram decreased by 4.9% between 2014/2016 and 2020/2022, the remaining ISSCAAP divisions show unit value losses exceeding 14% between the two periods, with an overall average decline of 10.1% for all species (all values in dollars of 2022).

[1] Como se ha indicado, salvo que se indique lo contrario, todos los valores monetarios de este texto están expresados en dólares de los EE.UU para 2022, usando como deflactor el índice de precios mayorista de ese país para todos los productos.

Figura 1 TMAAs (%) de los volúmenes mundiales cosechados y sus valores de primera venta entre 1990 y 2022 . Valores expresados en dólares de 2022

Fuente: Cálculos del estudio, sobre información FAO, Fishstat, 2024

Figura 2 Mundo: Valor medio anual de primera venta de productos de la acuicultura, por división de especies CEIUAPA de FAO, 1984-2022 U$ de 2022/kg

Fuente: Cálculos del estudio sobre cifras FAO, Fishstat 2024

Figura 3 Mundo: Valor medio anual de primera venta de productos de la acuicultura por continente, 1984-2022 US$ de 2022 por kilo

Fuente: Cálculos del estudio sobre cifras FAO, Fishstat 2024

The average values per kilogram of harvests from 1984/1986 to 2020/2022 show that after an initial increase, which lasts very briefly, prices of global aquaculture tend to decrease until 2005/2007, then increase until 2017/2019, only to decrease again in 2020/2022. As is generally the case, periods of declining prices tend to coincide—although not necessarily—with those when crops show their greatest growth. This phenomenon implies that the process of sectoral development has been accompanied by systematic efficiency gains over time, allowing for the absorption of these price declines.

Currently, however, and for several years now, the need to secure farming sites at reasonable costs and conditions, is inducing parts of the coastal marine production to move inland (RAS systems) or to ocean environments more exposed to winds and waves. These processes are undergoing a phase of experimentation and improvements, which involves higher investment and production costs compared to conventional techniques. Thus, with aquaculture being the dominant source in global fishery production, it is possible that new ventures associated with these new technologies may attempt to pass at least part of these higher costs onto prices. However, recent econometric studies by the OECD and FAO , which extend into the early part of the next decade indicate that by the early 2030s, there will be a decrease in unit prices in constant USD compared to current prices. Nonetheless, the same models establish that there will be price increases in nominal dollars throughout this period.[1], que se extienden hasta principios de la próxima década, indican que para esas fechas habrá una disminución en los precios unitarios en dólares constantes, en comparación con los precios actuales. No obstante, los mismos modelos establecen que habrá aumentos de precios en dólares nominales a lo largo de este período.

CONSUMPTION AND TRADE

Virtually all aquaculture products of animal origin are used for direct human consumption, and it is estimated that 89% of total landings (including aquaculture) had this same use in 2022, with the remainder primarily used to produce fishmeal and oil (83%). As well, 43% of the overall production is distributed fresh or chilled, 35% as frozen products, 12% as canned goods, and 10% dried, salted, or smoked.

FAO's latest figures also show a significant shift in the geographical structure of global fish consumption. While in 1961, 47% of fish consumption took place in Japan, Europe and the United States of NA, by 2021 this percentage dropped to 18% of the total, while China, Indonesia, and India increased their share from 17% to 51% of consumption over the same period, with China alone accounting for 36%. The consumption of fish and aquaculture products has become increasingly concentrated in Asia, a continent that absorbed 72% of global availability for human consumption in 2020, compared to just 48% of these totals in 1961 (FAO, SOFIA 2022 ). In contrast, Europe's share of these products has decreased from 32% to 10% of totals over the same period, and the United States of NA, from 9% to 5%.

Human consumption of fish products varies greatly between countries and regions, with some consuming more than 80 kg per capita per year (Iceland, Faroe Islands, and the Maldives) in 2019, while low-income nations consume only 5.4 kg; lower-middle-income nations, 15.2 kg; upper-middle-income nations, 28.1 kg; and high-income nations, 26.5 kg. However, excluding China from the upper-middle-income countries, their consumption drops sharply to 13 kg per capita in that year. Overall, the apparent per capita consumption of fish products reached 20.7 kilograms globally in 2022, up from 20.2 kilograms in 2020 and 16.9 kilograms in 2000.

It is concerning that Latin America and the Caribbean, as well as Africa, show very low fish consumption levels, equivalent to approximately 50% of the global average values, which, while indicating interesting growth opportunities, also presents enormous challenges for increasing them. These challenges are associated with the income levels of their inhabitants, the prices of fish and alternative products, quality and technological aspects and other issues. In the case of LAC, the habit of consuming other meats is deeply rooted in local cultures, and therefore shifts toward fishery products is fairly challenging.

It is also well known that fish products contribute significantly to human nutrition, providing 20% of daily per capita proteins for about 3.2 billion people, particularly in low- and middle-income countries. Additionally, aquatic foods contribute around 17% of the animal protein in the average global diet (2020) and 7% of total proteins.

Between 30% and 40% of global landings have been directly or indirectly incorporated into various final products for international trade in recent years, a situation that has allowed for the creation of highly competitive industries in many countries of origin, facilitating consumption in nations that do not have adequate fish resources or have not yet wanted or been able to develop aquaculture to deal with their unmet demand levels. The trade in aquatic products continues to grow, involving more than 230 countries and territories in 2022 and generating a record value of USD 195 billion. It is notable that these sales represented more than 9.1% of total agricultural trade (excluding forest products) and around 1% of the total value of merchandise trade (SOFIA, 2024).

The high level of globalization in fish trade also has additional strategic repercussions. Exporting countries must face strong competition in terms of prices, quality, and other attributes in their target markets, requiring increasing and sustainable levels of competitiveness over time, the permanent incorporation of technology, and a clear medium- and long-term vision. These factors justify the sophistication and size of the fishing industry in countries such as Peru, Chile, Ecuador and many others oriented toward international sales. However, small-scale fishing and aquaculture, which preferably serve domestic supplies in their respective countries and may even export, are generally viewed with paternalistic eyes, excusing their possible low levels of technology and competitiveness and not addressing their undeniable organizational, technical, and commercial assistance needs with sufficient or efficient state support measures. As a result, these producers are exposed to competition with highly standardized imported products, which already affect and may further disturb their sustainability, necessitating appropriate support policies commensurate with their real needs. These challenges faced by small-scale producers are valid for most (if not all) developing countries, at least in LAC and Africa, and do not receive adequate attention beyond 'cosmetic' responses that have not allowed significant progress in these areas and that challenge the generation of jobs for modest producers, generally in rural areas, with few alternative employment opportunities.

It is also noteworthy that exports of fishery products of animal origin increased from USD 7.9 billion in 1976 to USD 192 billion in 2022, with a nominal CAGR of 7.2% and a real CAGR of 4.0%, as a result of the conjunction of several situations, such as greater efficiency of producers, a greater diversity of products, better quality, greater availability throughout the year, more liberal and globalized trade policies, technological, logistics and storage improvements, and consumers more aware of the nutritional advantages of these products, etc.

China remained the leading exporter of aquatic animal products in 2022 (12% by value), followed by Norway (8%), Vietnam (6%), Ecuador (5%), and Chile (4%). The European Union (EU) was the largest single market, importing USD 62.7 billion in aquatic animal products, including USD 29.5 billion in intra-EU trade (SOFIA, 2024).

Individually, the largest importing country in 2020/2022 in terms of value was the United States with USD 32.910 billion (16.3% of the total), followed by China with USD 21.471 billion (10.7%), Japan with USD 16.806 billion (8.3%), Spain (4.9%), and France (4.3%). On the other hand, the main ISSCAAP divisions of imported products in 2020/2022 in terms of value were fish (66.8% of the total) and crustaceans and molluscs (32.5%). At the same time, salmonids continue to be the most imported ISSCAAP species group (19% in value), followed by shrimp and prawns (16%), unidentified marine fish (13.8%), tunas, bonitos, and billfishes (9.5%), cods, hakes, and pollocks (9.4%), and cephalopods (5.9%).

It is important to mention that with growing future demand for sectoral products, real availability for human consumption could be significantly increased if at least part of the losses due to poor handling in current production could be remedied. These losses, which amount to between 30% and 35% of availability in much of the world , are associated with the lack of refrigeration, improper handling, inadequate transportation, storage, and distribution infrastructure, and/or lack of knowledge, among many other reasons. Likewise, the FAO has also estimated that discards from bycatch in extractive fishing activities can reach significant levels (a figure of around 20 million tons annually was mentioned a few years ago), a situation that requires special attention in light of the scarcity of conventional fishing and food insecurity in many countries.

The increase in farmed volumes, and the fact that a growing portion of them (over 50%) are fed man-made feed, has been accelerating the pressure on the production of fishmeal and fish oil. Therefore, in 2020, 86% of their production was destined for fish farming, with only the remaining 14% going to mammals and birds (9% to pigs, 4% to domestic animals and other uses, and 1% to birds). Meanwhile, their prices have risen significantly. In the case of fish oil, 73% of the 2020 production was consumed in aquaculture, 16% went to produce products for human consumption, and 11% was allocated to pet food, biofuel, and other uses (SOFIA, 2022). Certainly, the high demand for fishmeal and fish oil in aquaculture, their relative scarcity, and high prices have limited their inclusion levels in aquaculture diets. As a result, fish meal and oil levels in diets have become increasingly selective, and are used mainly in critical stages of production, while growing amounts of new natural inputs of animal or plant origin, as well as synthetic products, are being incorporated into diets without affecting rearing effectiveness.

Finally, the latest available FAO Statistics (SOFIA 2024) indicate that employment in aquaculture primary activities reaches about 22.1 million people in 2022, with 95% concentrated in Asia (2% in LAC countries).This total figures is almost double the level of 11.5 million recorded in 1995 and is practically equal to the value of 2010, with the figure for 2020 slightly higher than that for 2022.

En resumen, la acuicultura mundial es cada vez más relevante, sobrepasando por primera vez los volúmenes de pesca extractiva en 2022. Aunque la actividad continua siendo dominada ampliamente por unos pocos países asiáticos, presenta significativas oportunidades de crecimiento en otras regiones, incluyendo ALC y África. La aplicación de prácticas productivas sostenibles y un buen balance entre producción e impactos ambientales serán cruciales para el futuro de esta vital industria.

LATIN AMERICA AND THE CARIBBEAN, LAC

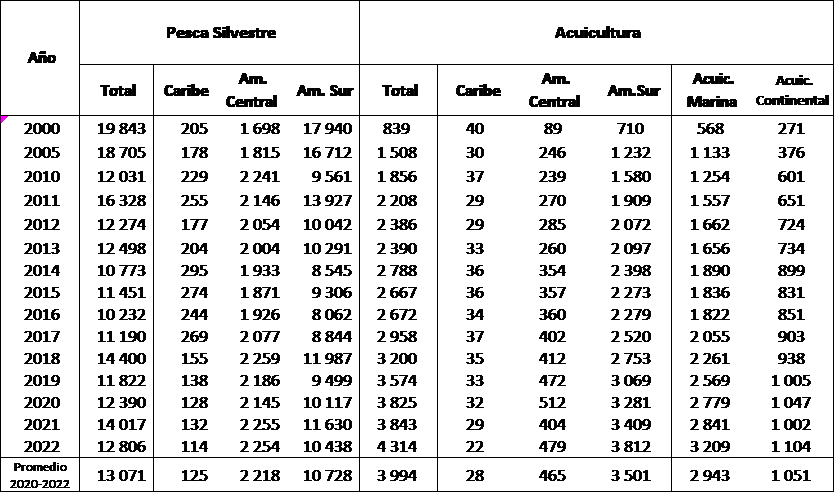

For the first time, aquaculture production in LAC (excluding algae) has surpassed the 4 million tons threshold in 2022—reaching 4.314 million tons—valued at $21.112 billion, exceeding the volumes and values of 2021 by 12% and 11%, respectively. This sector contributed a significant 25.2% to the region's total landings in 2022, compared to 21.5% in 2021. These developments occurred alongside a decrease in extractive fishing, which dropped from 14 to 12.8 million tons between 2021 and 2022. Therefore, and despite the growing contribution of aquaculture, the region's overall landings for the two-year period declined from 17.9 to 17.1 million tons, with the largest losses in South America.

Between 2000 and 2022, total landings in LAC decreased by nearly 3.6 million tons (with a CAGR of -0.9%), as a result of a reduction of over 7 million tons in extractive fishing (CAGR of -2%) and an increase of almost 3.5 million tons in aquaculture production (CAGR of 7.7%). The decline in extractive fishing volumes is largely associated with decreases in small pelagic species, primarily used in the production of fishmeal and fish oil. These species declined by 6.9 million tons (CAGR of -2%) in marine environments and by 110,000 tons (CAGR of -1.2%) in freshwater environments. Conversely, marine aquaculture grew by 2.6 million tons (CAGR of 8.2%) from 2000 to 2022, and continental aquaculture increased by 833,000 tons (CAGR of 6.6%).

As a result, aquaculture in LAC grew faster than global averages during this period (CAGR of 5%), while local extractive fishing decreased at a more rapid pace than globally (CAGR of -0.1%). These changes in local production structure mean that, in 2022, LAC's landings accounted for 9.2% of world totals; extractive fishing contributed 14.1%, and aquaculture contributed 4.6% (but 7.1% in value), a proportion that has been steadily increasing from 3.5% in 2016.

[1] OECD-FAO, 2024. Agricultural Outlook 2024-2033, https://doi.org/10.1787/4c5d2cfb-en

[2] SOFIA, The State of World Fisheries and Aquaculture, op. cit. Aplica a este párrafo y a los textos vecinos, algunos de los cuales son citados casi textualmente.

[3] FAO, SOFIA, 2024

Tabla 10

ALC: Desembarque total, pesca y acuicultivos por subregión, 2000-2022, Miles de tons

Fuente: FAO, Fishstat 2024

In 2022, LAC cultivated a total of 116 species, most of them in South America (74). Additionally, 74% of aquaculture harvests in 2022 were produced in marine environments, with only 26% in freshwater, contrasting with world patterns where 63% of harvest volumes are produced in freshwater from 432 cultivated species .[1]

South America dominates regionally both in extractive fishing (82.1% of local totals from 2020 to 2022) and in the volume of aquaculture production (87.7% of totals for the same period).

[1] El número de especies ha sido calculado en base a datos de Fishstat, 2024. Cuando allí se refieren a grupo de especies, como ‘peces marinos varios’, esa categoría se asocia a una especie solamente, por no existir forma de estimar cuantas especies pudiese contener dicho grupo.

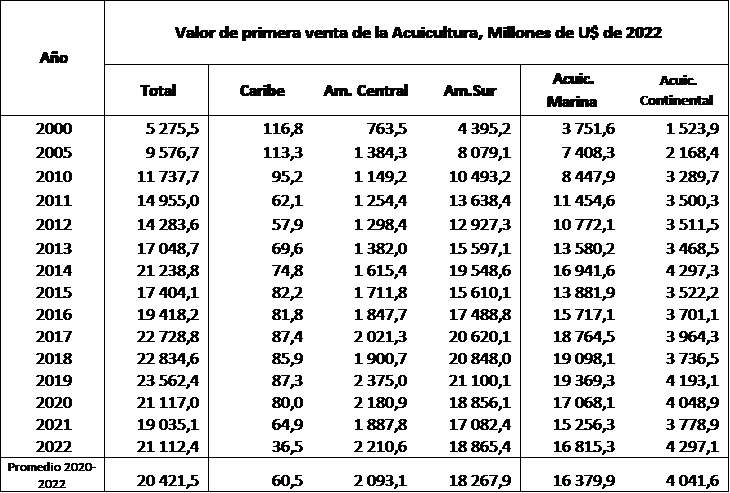

Tabla 11

ALC : Valor total de primera venta de la acuicultura, por subregión, 2000-2022

Fuente: Cálculos del estudio y cifras de FAO, Fishstat, 2024

Central America is the only LAC subregion to show positive growth rates in extractive fishing between 2000 and 2022 (CAGR of 1.3%). It also shows the highest regional dynamism in aquaculture (CAGR of 8% during the period), followed by South America (CAGR of 7.9%), which anyway shows substantially higher volumes. In turn, the Caribbean reports negative variation rates for both fishing and aquaculture during the same period (CAGRs of -2.6% in each case), confirming its limited vocations in these sectors, but particularly with aquaculture, which competes unfavorably with the region's significant tourism industry that demands space, water and other scarce local resources. When comparing the average catches and aquaculture outputs per subregion between 2000/2002 and 2020/2022, extractive fishing lost relevance in South America but gained in Central America. Meanwhile, aquaculture became even more prominent in South America, sharply declined in the Caribbean and remained relatively stable in Central America.

Additionally, the first-sale value of ‘marine aquaculture’ in LAC, which accounts for 80.2% of the total harvested in 2020/2022, represents only 73.7% of the cultivated volumes during the same period.

On a broader perspective, spanning from 1990 to 2022, the extraordinary dynamism of local aquaculture production is shown by a growth of 1,513% over the period, compared to a significant but smaller world increases of 547%.

Tabla 12

ALC y subregiones: volumen y valor de las cosechas medias anuales en las últimas décadas; tasas de variación medias acumulativas anuales (TMAA,%) y comparaciones , 1990-2022

Miles de tons, Millones de U$ de 2022 y porcentajes

Source: Calculations of the study on Fishstat figures, FAO, 2024

Despite the significant growth in aquaculture production, the rates of change in farmed volumes worldwide, in LAC, and within its subregions have been declining over the years. During the decade ending in 2020/2022, these rates were less than half of those seen in the 1990/1992 decade. However, the growth rate of aquaculture volumes in LAC far surpasses the global average. The same cannot be said for first-sale values ("ex-farm"), where the CAGRs in LAC exceeded global values during the 1990s and 2000s but were surpassed by them in the decade ending in 2020/2022. This fact raises questions about the development process of local aquaculture, which must be addressed to ensure sectoral income, given its significant contribution to the economies of several countries.

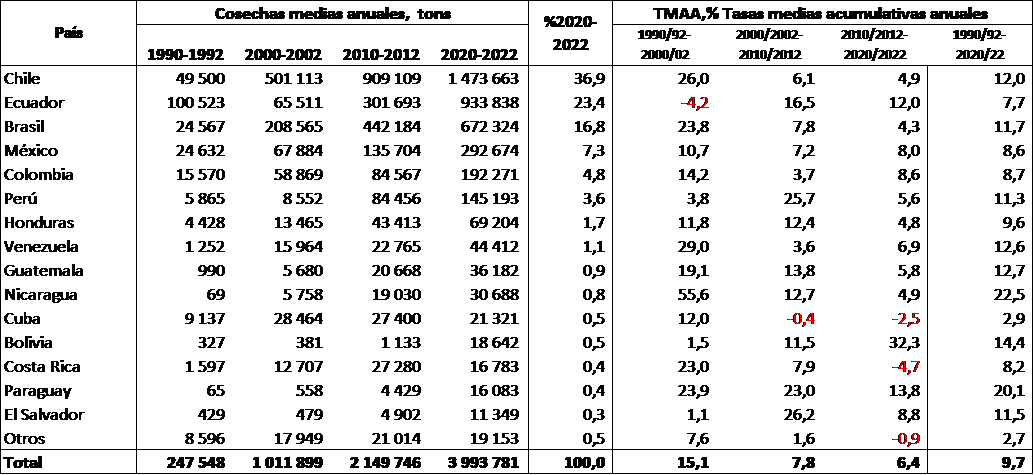

Between 2020 and 2022, Chile led LAC aquaculture in production volumes, accounting for 36.9% of the regional total, followed by Ecuador with 23.4%. Among the 45 countries or territories for which statistics are available, the top five countries (Chile, Ecuador, Brazil, Mexico, and Colombia) concentrated 89.3% of these harvests. This figure exceeds the 86.8% these nations accounted for in 1990/1992, reflecting the increasing concentration of continental aquaculture in these countries. Consequently, the remaining 40 countries/territories contributed just over 10% to regional volumes harvested, highlighting the nascent nature of aquaculture in LAC. Additionally, 9 out of the 15 countries exhibit CAGRs on volumes produced exceeding 10% between 1990/1992 and 2020/2022. AS well, Chile alone accounted for 53.6% of first-sale values in 2020/2022, followed by Ecuador with 20.2%. Combined, the first-sale harvest values of Chile, Ecuador, Brazil, Mexico, and Colombia represented 90.2% of the regional aquaculture ex-farm values.

Tabla 13

ALC: Producción de cultivo en los principales países de la región, 1990-2022.

Toneladas y porcentajes TMAA

Fuente: Cálculos del estudio sobre cifras FAO, Fishstat 2024

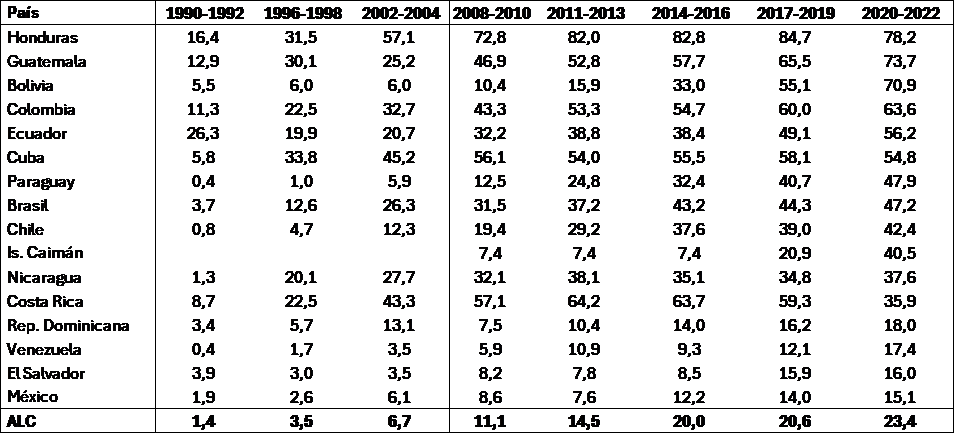

In all, aquaculture has significantly increased its relative importance in LAC landings. While it represented only 1.4% of totals in 1990/1992, this figure rose to 5.2% in 2000/2002, 13.7% in 2010/2012, and an impressive 23.4% in 2020/2022.

Similarly, aquaculture has acquired varying degrees of importance over time in different LAC countries. Between 2020 and 2022, aquaculture accounted for over 70% of landings in three countries (Honduras, Guatemala, and Bolivia). In the next seven countries, the contribution ranged from 40% to 69%, while in six nations, it exceeded 10%. In the remaining 35 countries/territories, aquaculture contributed only up to 10% of national landings.

Tabla 14

ALC: Importancia relativa de la acuicultura en países de la región donde la actividad significa más del 10% del desembarque en 2020-2022. 1990-2022. % del desembarque total

Fuente: Cálculos del estudio sobre cifras FAO, Fishstat 2024

A low ‘relative’ participation of aquaculture in landings is understandable in a country like Peru, which despite harvesting a notable 145,000 tons annually in 2020/2022, this figure pales compared to its position as the region's largest extractive fishing producer (5.8 million tons annually in the same period). However, this does not explain the situation of Argentina, where despite having an extensive coastline and excellent freshwater resources, aquaculture contributed only 0.5% to local landings during the same period, with just over 3,900 tons annually. This figure could be easily surpassed if greater importance were assigned to this activity and appropriate leadership exercised to complement the 846,000 tons of annual extractive fishing during the same period. A similar observation applies to other countries, but each case requires a distinct analysis to determine its “productive vocation,” future potential, and sustainable development pathways.

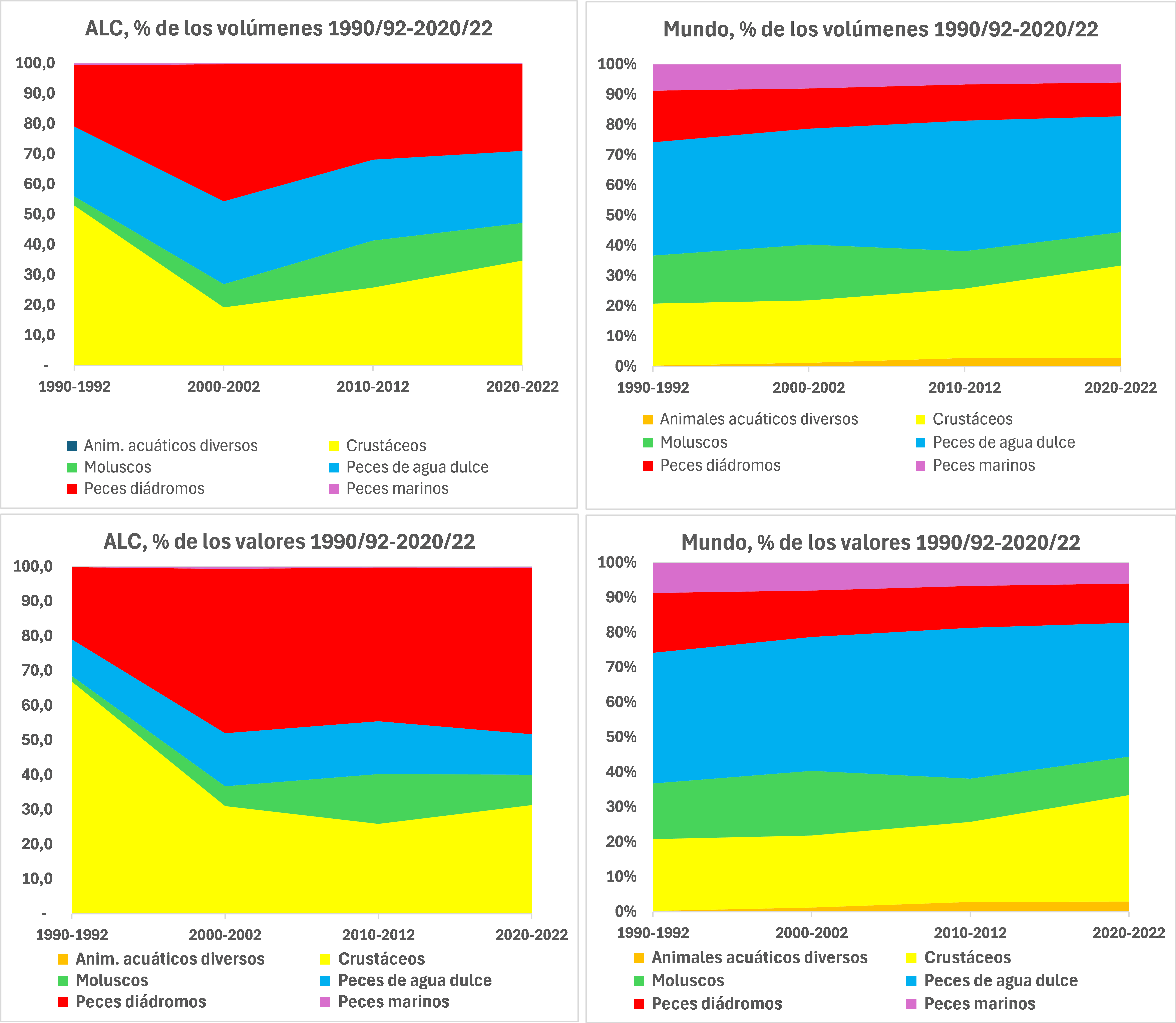

Aquaculture figures in the LAC region also reveal significant developments and changes in the relative importance of the various ISSCAAP species groups. While crustaceans accounted for 52.9% of the volume and 66.8% of the value of harvests in 1990/1992, their share dropped to 34.7% of the volume and 31.3% of the value in 2020/2022. This shift has allowed for a greater contribution from diadromous fish (such as salmon and trout), which, although accounting for only 20.3% of the volume and 20.9% of the value in the first period, represented 28.7% of the volume and an outstanding 47.9% of the value of LAC aquaculture in 2020/2022. Molluscs and diadromous fish have grown in volume at an annual average growth rate exceeding 10% over these past 30 years (15% and 11%, respectively). Adding marine fish to the previous categories, their first-sale values have grown with CAGRs of 13.8%, 10.5%, and 11.3%, respectively.

Overall, harvest volumes over the past three decades increased from 247,500 tons to 3.993 million tons annually, achieving a notable CAGR of 9.7%. In terms of total value, regional aquaculture grew from $2.322 billion to $20.421 billion during the same period (CAGR of 7.5%).

Tabla 15

ALC: Volumen, valor total, valor por kilo y TMAAs de los cultivos, por división CEIUAPA, 1990-2022

Fuente: Cálculos del estudio sobre cifras FAO, Fishstat 2024

These figures also indicate that while the average annual farm-gate sale prices of regional aquaculture was of $9.4 per kilo in 1990/1992, it dropped to $5.1 per kilo in 2020/2022. This latter value is the lowest among the average annual prices of the past three decades (in 2022 currency).

Now, comparing the worl aquaculture production structure with that of LAC, notable differences emerge, as in LAC, crustaceans and diadromous fish dominate in terms of volume, while freshwater fish and molluscs prevail globally. This disparity also explains the difference in average prices per kilo between LAC and global harvests, with LAC significantly surpassing global average values.

A similar pattern is observed in total harvest values, where diadromous fish and crustaceans are predominant in LAC, while freshwater fish and crustaceans lead globally.

Figura 4 ALC y Mundo: Estructura del volumen y valor de las cosechas acuícolas, por división de especies CEIUAPA, 1990/92-2020/22 . % de los totales de cada trienio

Fuente: Cifras de Tablas 5 y 15

It is also important to highlight that LAC stands out for its surplus trade balance in volume and value of fishery and aquaculture exports. The region achieved an average annual surplus of 4.45 million tons and $21.555 billion in 2020/2022, resulting from exports of $27.607 billion and imports of $6.052 billion annually . Globally, fishery product exports per year reached $203.118 billion during the same triennium, meaning that LAC accounted for 13.6% of the total in 2020/2022.

The United States is the world's largest importer of fishery products, with an annual average of $32.910 billion in 2020/2022. China follows with $21.471 billion, and Japan ranks third with $16.806 billion annually in that period. Together, these three countries represent 35.3% of global fishery imports during this period and rely heavily on foreign suppliers, presenting an attractive opportunity for Latin American exporters and aquaculture producers. Many European Union countries also represent important fishery markets for LAC, with high annual import values. Nations such as Spain, France, Italy, Germany, Sweden, and the Netherlands each import over $5.900 billion annually in 2020/2022, while the next 11 countries conduct imports ranging from $2 to $5.4 billion annually during this period. This expands the sales opportunities for LAC aquaculture producers. However, LAC is not the only significant fishery exporter, as Europe, despite being a major importer, is the leading continent for fishery exports, with $74.759 billion annually in 2020/2022, slightly surpassing Asia, which exported $73.273 billion annually during the same period. This underscores the high levels of competition in importing markets and the need for LAC to maintain highly competitive and well-organized fishery and aquaculture industries.

It is also worth mentioning that, similar to fishery production trends, global exports have experienced fluctuations in their growth rates. While exports grew at an annual average rate of 2.8% between 1990/1992 and 2000/2002, they increased to 3.9% annually between 2000/2002 and 2010/2012 but slowed down to a rate of 1.9% annually between 2010/2012 and 2020/2022. Moreover, as previously mentioned, it is expected that the pace of these growth rates will slow further, at least until 2033. This situation will require greater efficiency from producers and the development of new market options for LAC aquaculture producers and globally.

THE NEAR FUTURE

The year 2022 shows progress in global and Latin American and Caribbean (LAC) aquaculture harvest volumes, with increases of 3.6% and 12.3%, respectively, compared to 2021. However, in a broader perspective, these growth rates do not offset the fact that over the past three decades, the compound annual growth rate (CAGR) of global aquaculture has continued to decline, from 9.4% to 4.2% per year between the decade beginning in 1990/1992 and the one ending in 2020/2022. A similar trend is observed in LAC, where the slowdown in farmed volumes is more pronounced, with CAGRs dropping from 15.1% to 6.4% per year over the same period. Nonetheless, over the past 30 years ending in 2020/2022, global and LAC harvest volumes have increased at CAGRs of 6.4% and 9.7%, respectively.

Now, considering the growth rates of aquaculture production in more recent dates on a triennial basis, aquaculture in LAC shows increasing dynamism, with a CAGR rising from 5.2% in 2011/13-2014/16 to 7.2% in 2017/19-2020/22, while world rates decline from 4.9% to 3.4% over the same periods. Therefore, although the CAGRs of harvest volumes have decreased globally and in LAC over the past 30 years (more sharply in LAC), recent trends provide more optimistic prospects for the region, which may be on the verge of breaking the decadal slowdown described earlier.

The figures also suggest that any significant growth in landings will have to be mainly associated with increases in aquaculture production, as extractive fisheries continue to show signs of weakness and exhaustion, which are also partially reversed in the last three trienniums (from -7.6% per year to +1.6% per year in the same periods mentioned above).

Certainly, technological and climate changes should significantly alter many of the numerical relationships in regional and global crops in the coming decades. In relation to this first aspect, emerging production in land-based recirculating systems (RAS) and offshore farming (production in exposed marine areas) should make it possible to increase crops in much larger areas than those currently used in countries with a developed aquaculture industry, as well as to generate massive production closer to or within the territory of current net-importers of fishery products, particularly in countries such as the USA, Japan, some areas of Europe, Brazil, Mexico and Asia. These facts should lead to fewer conflicts with other users of the coastal zone and inland waters, with better chances to obtain more easily farming licenses, and presumably, at much lower costs in the medium and long term .[2].

At present, the extent of climate and technological change effects cannot be predicted with numerical precision in these paragraphs, but everything seems to indicate that, especially as from the 2030s, there will be structural alterations of magnitude in world aquaculture, which will result in the coastal zone gradually and mainly being left in the hands of the small artisanal/family farmer, which will supply specially cities and nearby rural populations, while medium and large industrial facilities gradually migrate to more unprotected marine areas ('offshore') or to land (RAS systems), specializing their sales in large urban domestic centers and/or exports.

Aquaculture production in LAC continental waters and in other parts of the world must also undergo modifications in their productive structure, seeking greater efficiency and competitiveness through greater and better associativity and social/productive organization of small producers; through the introduction of appropriate management systems, innovative technologies and greater intervention in marketing, supported by effective official technical assistance programs. In turn, increasing activities by medium and large-sized companies, which should also accelerate their innovation processes in inland waters are also to be expected.

Beyond all of the above, LAC and many other regions of the world also continue to work vigorously on diversification activities through the introduction of new species that are still little or not at all exploited, and the enabling of new areas for aquaculture, although, frankly, in a relatively discontinuous and not very organic way, at least in Latin America and the Caribbean.

Of particular interest is the work with multiple native species – most likely too many – but still with a limited level of success in technological and market developments, as a result of often poorly oriented and/or without continuity over time programs and projects, and low investment in R&D, at least in LAC. It is also evident that an important part of the most promising technological innovation likely to be massively used, still comes from high developed countries, most of which- curiously enough - do not show a special vocation for aquaculture growth in their own territories so far, despite usually standing out as importers of fishery products. Conversely, many countries in LAC and other regions of the world have ample space, infrastructure and environmental conditions, and are looking to develop a competitive aquaculture to improve food security and increase exports but face severe limitations precisely because of technical gaps in the design of new production systems needed for native species, inappropriate R&D schemes, lack of trained human capital and insufficient investment in marketing activities. Obviously, then, there are interesting prospects to develop strategic alliances, mainly north-south, which could translate into great achievements for their participants.

The limited domestic markets and export opportunities have led countries such as Chile, Ecuador, Honduras and others to orientate their aquaculture activities towards foreign trade, an issue that has determined that sectoral firms in those places – especially in the case of Chile – have been designed using medium and large production sizes and state-of-the-art technologies, to take advantage of economies of scale and obtain appropriate levels of competitiveness. They have succeeded in these endeavors, while other nations with incipient aquaculture production face greater challenges in joining fairly globalized markets , a situation that inhibits the development of some crops.

It is also notorious that in several countries, but especially in LAC, governments show a mainly 'comptroller/regulatory' vocation towards aquaculture, with personnel who are not necessarily well qualified – generally with more experience in fishing – and neglect their important leadership role to promote further sectoral development. Thus, regulatory environments do not necessarily facilitate investment and a greater participation of the business sector, nor help adequately addressing the needs of small producers, who in many cases continue to be marginalized.

It is also clear that climate change is strongly affecting many regions of the world in their capacities to project their aquaculture productions into the future. The increasing variability in the availability of fresh water, the need to have adequate installations and equipment to overcome more frequent and significant swells, storms and torrential rains or droughts; changes in the temperature and acidity of marine waters and many other circumstances are limiting or at least complicating the desire to invest in global aquaculture.

Governance is also usually inadequate and bureaucratic, with a tendency to 'overregulate', while frequently needing long periods of time to issue farming licenses and other authorizations, through expensive and time-consuming processes and questionable duration periods, sometimes too short to satisfy investors. Also, possible levels of saturation of some markets are being experienced and a growing and aggressive competition from poultry and pig producers is becoming more evident by the day. These facts added to increasing transportation and other costs explain a good part of the why harvest growth rates have systematically slowed down in LAC and around the world in recent decades.

The clear trend towards moderation/decline in the rates of growth in world harvests should be of concern, as it may presage more challenging scenarios in the future, when possible slacks exploited up to now decrease or disappear and the industry as a whole faces a slower growth scenario and/or even a certain immobility that may lead to rethinking the role of world aquaculture in seafood supplies beyond the 2030s.

For the time being, however, it is reassuring that the total apparent consumption of fishery products to feed the population has increased between about 127.6 million tons in 2010 to about 162 million tons in 2021 , or by 27% since the first date. These figures contrast with a population growth of only 13.2% until 2021, a fact which allowed per capita fish consumption between those years to increase from 18.5 kilos to 20.5 kilos per person. However, between 2010 and 2019 human consumption in Europe decreased from 22.3 kilos per person to 21.7 kilos and in Africa it remained static at 10.1 kilos, so that the real engine of world fish consumption continues to be Asia, where consumption per person increases from 20.8 kilos to 24.5 kilos between 2010 and 2019, with total values growing from 87.3 to 113.2 million tons between those years, an increase of 29.7%, compared to a surge in population of only 9.7%.

It can be added that the latest OECD-FAO publication Agricultural Outlook 2024-2033, of July 2024, indicates that by 2033 a per capita consumption of fishery products of 21.4 kilos could be reached. This figure surpasses the estimated 20.8 kilos in 2021/2023. Thus, the expected consumption per person in the coming years will grow on all continents except Europe and Africa. Asia will further rise the high per capita consumption observed today and will be responsible for 77% of the increase in total consumption between 2021/2023 and 2033. Likewise, it is projected that approximately 90% of the world's fish landings will be destined for human consumption, a figure very similar to the current one.

However, current fishery exporting countries must prepare for a change of scenarios in international trade until 2033, since according to the OECD-FAO Outlook 2024-2033, it is expected that 95% of the increase in consumption until that year will be associated with low and middle-income countries, which with this new impetus will be responsible for 82% of the world’s use of fish products for human consumption by then. Thus, in these countries, consumption will increase by 15% between 2021/2023 and 2033, while in developed countries, by only 3.3%.

It is also anticipated that by 2033 global fish production will reach about 206 million tons, after an estimated landing of about 186 million tons in 2023, with a growth of only 21 million tons compared to the 2021/2023 period, generating an increase of 12%, versus 21% in the immediately preceding decade. In any case, this increase will be mainly related to the development of aquaculture, which should contribute 112 million tons in 2033, or 55% of the global fish landing by then (50.9% in 2022). It is also anticipated that around 80% of the increase in global aquaculture production by 2033 will be associated with additional harvests in China, India, and Indonesia. China would stabilize its contribution to global aquaculture, accounting for approximately 55% of the totals.

However, the evident slowdown—and even stagnation in some regions of the world—of the apparent per capita consumption (and production) of fish and aquaculture products is indicative—as confirmed by SOFIA 2024 and the cited OECD/FAO 2024-2033 publication—that the sector’s productive dynamics will continue to decline in the period ending in 2033, and that the same will happen with international trade until those dates, which in any case will cover more than 30% of landing weights. Thus, if this trend continues as a result of the conjunction of limiting variables of different nature (environmental, governance, technological, market, and more), for the first time in many decades, it could be imagined that in years beyond the 2030s, the advance of aquaculture could be restricted, with possible significant effects on less efficient producers.

Certainly, the speculative limitations just described do not necessarily define the future scenario of global and regional aquaculture, as there are important signs of vitality and sectoral talents that strive and will strive to overcome the above mentioned inconveniences and make use of the undeniable conditions and capacities to produce valuable food for a population that will continue to grow in the coming decades. Therefore, the expected situations, more challenging than in previous decades, call for more planned work and a long-term vision, to design strategies appropriate to the new conditions.

At present, a good number of sectoral actors in many places think more in the short term and somehow ignore the need for extensive preparatory periods to innovate, diversify, and become more competitive, a fact which leads to the misuse of relatively scarce human and financial resources, and challenges the opportunity to generate a better and more energetic aquaculture development process. Furthermore, in many LAC countries and other corners of the world, significant state investments to support small producers are massively implemented without an adequate understanding of their true scope and effects, and usually with little success. These initiatives are rarely evaluated at their conclusion, so not much is known about their social profitability and effectiveness, a fact which conspires against the good use of available financing. The same happens with funds allocated to R&D in many countries, particularly in LAC, as they do not seem to be applied where they are most needed, consistently over time and for the required periods of time.

Regardless of the 2022 results, the persistent declines in global aquaculture growth rates call for caution in projecting farmed volumes to be expected in coming years in many regions of the world, although not necessarily in LAC, where a possible realignment of sectoral governance, better leadership, and the generation of new medium- and long-term objectives and goals in countries such as Brazil, Peru, Argentina, Colombia, Mexico, in addition to Chile and Ecuador, can greatly energize the sector with additional productions.

Certainly, many countries in other latitudes are currently developing significant land-based, recirculation farming projects to alleviate their deficits in domestic fish production, as is the case of the USA. These projects, many of which will come into operation in the second half of this decade or thereafter, along with many others in Norway, Arab countries, and other nations, will not only reconfigure the global aquaculture production matrix but will challenge traditional exporters such as Ecuador and Chile, which, exposed to new productions of salmon, trout, or shrimp in consumer markets, mainly in the developed world, will force them to redirect part of their traditional exports to other places. In the case of Norway, a country that generates significant aquaculture surpluses, the initiative has already been taken to invest directly in cultivation in its client countries, such as the USA, to limit with due anticipation the possible negative effect of these challenges. That country also leads efforts to establish new techniques for offshore cultivation.

Years pass, but world aquaculture volumes continue to be highly concentrated in a very small number of countries, led by China (56% of cultivation in 2022) and several other Asian countries, a continent that alone is responsible for 88.3% of aquaculture production in 2022, while LAC only generates 4.6% of harvests in that same year. Thus, middle-income countries (including China) generate 92.2% of harvest volumes in 2022, high-income countries (USA, Europe, Japan, Australia, and others) only 7.6%, and low-income countries, only 0.3%.

The concentration of crops by species is less noticeable but still pronounced, with 51.3% of volumes associated with the 10 predominant species, led by Ecuadorian shrimp. Except for this crustacean, various oysters, and the Japanese clam, the remaining 7 species correspond to freshwater fish, mainly carp, but also include Nile tilapia. These species have high demand in domestic Asian markets, whose consumption of animal protein are strongly linked to the intake of fish products in general. Tilapia, in turn, is already cultivated in many countries on several continents, having gained great relevance in the production and domestic consumption of nations such as Brazil and others.

Markets such as Japan and others in Europe already show some level of saturation in fish consumption by their population in recent years, and their more affluent inhabitants demand increasing amounts of other meat products, although they maintain their high level of fish and aquaculture product consumption. As well, countries such as the USA and the European Union heavily depend on fish imports and also show high per capita fish consumption levels. As long as these facts prevail, and even if intake levels no longer increase as before, LAC’s exportable aquaculture production will have significant market opportunities there and increasingly in middle-income and emerging nations in coming years. This does not mean that regional farming will be free of problems, as in the case of Ecuadorian shrimp production in 2023, which, reaching record levels, saw its prices drop drastically due to global overproduction, creating complex financial situations in many local shrimp companies.

In any case, global and LAC aquaculture will continue to advance, and the recently published figures for 2022 reaffirm this fact. Of course, as indicated, future scenarios will be subject to strong pressures for change, on account of climatological, technological, environmental, governance, market, and sustainability issues, which will force countries to develop new strategies, according to their realities, to take advantage of their best opportunities and avoid the eventual negative consequences of increasingly challenging scenarios.

[1] A la fecha de elaboración de este informe no había cifras agregadas disponibles de comercio exterior para 2022. Igualmente, no se puede diferenciar con precisión entre productos asimilables a la pesca extractiva de aquellos que provienen de la acuicultura. Adicionalmente, todas las cifras de comercio exterior de estos párrafos están expresadas en dólares del año 2021, y no de 2022, como ocurre con el resto del texto.

[2] La legislación/normativa para los cultivos offshore e inclusive RAS no se encuentra bien desarrollada a nivel mundial, y de ella depende que estas nuevas localizaciones sean viables, más baratas y fáciles de conseguir.

[3] Se hace notar que en años recientes se verifican nuevas tendencias proteccionistas en diversos países que pueden atentar contra la globalización del comercio pesquero internacional, tal como se le observa en la actualidad. Estas tendencias son difíciles de cuantificar, pero podrían generar dificultades a los exportadores tradicionales y emergentes de estos productos.

[4] Los datos de FAO cubren hasta el año 2021, pero no se utilizan las cifras para 2020 y 2021, porque ellas evidencian que han sido estimadas por esa institución a nivel mundial y que en las bases de dato Fishstat se les asigna el mismo valor que para 2019. Las cifras publicadas en Junio de 2024 en SOFIA 2024 (op.cit.) indican que el consumo humano total de productos pesquero en 2022 alcanzaría a unos 164,6 MM de tons, mientras el valor aparente por persona sería de 20,7 kilos. Los valores restantes expuestos en estos párrafos del texto han sido obtenidos de las bases de datos de consumo aparente de alimentos de FISHSTAT, y pueden no coincidir con cifras de otro origen.

[5] SOFIA 2024, op.cit.,página 103

Oficina Central: Ciudad de Panamá, Panamá

Oficinas de representación: Chile, Ecuador, EE.UU. de N.A., México, Australia y Noruega

CONSTRUYENDO UN FUTURO AZUL…..